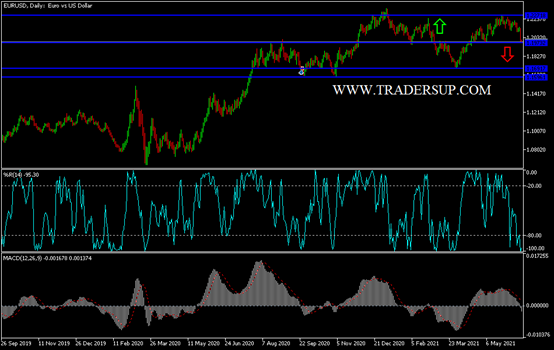

Amid the worst daily performance of the EUR/USD currency pair in months, the pair collapsed from the resistance level of 1.2135 to the support level of 1.1994, which is stable at the beginning of trading today. The pair is affected by the strength of the US dollar, in response to the US Central Bank’s hint of when to tighten its policy, stronger than market expectations. The Federal Reserve issued its highly anticipated monetary policy announcement, and while the statement was largely unchanged from the previous meeting, the latest US central bank projections now point to an increase in interest rates in 2023.

The latest forecasts from Federal Reserve officials indicate that US interest rates will rise to 0.6 percent in 2023 compared to previous expectations that rates will remain near zero levels. Officials expect a rate hike by 2022. The forecast for a rate hike in 2023 comes as the average estimate for GDP growth for the year has been raised to 2.4 percent from the 2.2 percent forecast in March. Core consumer price inflation is still expected to rise by 2.1% in 2023.

Commenting on the decision, Paul Ashworth, chief US economist at Capital Economics, said: "We assumed the Fed would be more willing to allow inflation in favor of ensuring a 'broad and all-encompassing' labor market recovery - and we only expected one rate increase of 25 basis points." “But it is clear that we misjudged the Fed’s evolving reaction function and inflation tolerance.”

The new estimates also show GDP growth of 7.0 percent in 2021 versus the previously estimated 6.5 percent, and core consumer price inflation is expected to reach 3.0 percent compared to the previous forecast of 2.2 percent. Despite upward revisions to expectations, the accompanying statement from the Fed did not change much from the April meeting.

The Fed reiterated that indicators of economic activity and employment had strengthened, noting progress on Covid-19 vaccines and strong policy support. The statement also acknowledged the rise in inflation but again attributed the increase to "temporary factors". The US central bank also said it plans to continue its bond purchases at a rate of at least $120 billion per month until "other significant progress" is made toward its goals of maximum employment and price stability.

Some analysts had expected the Fed to indicate that it had begun to consider reducing its asset purchases in light of the strength of the economic recovery and rising inflation. In his post-meeting press conference, Federal Reserve Chairman Jerome Powell said that the benchmark for "significant additional progress" remains "a long way off" and stressed that the central bank would provide "advance notice" before making any changes to asset purchases.

As widely expected, the Fed also maintained the target range for the federal funds rate at zero to 0.25 percent, where it has been since March 2020. The Fed said it expects rates to remain at near-zero levels until labor market conditions reach to levels consistent with his assessments of maximum employment and inflation is on track to moderately exceed 2% for some time.

EUR/USD technical analysis: There is no doubt that yesterday's event was a strong pressure factor on the performance of the EUR/USD currency pair. On the chart of the daily time frame, there is a clear break of the general trend to the downside, and as I mentioned before that breaching the psychological support 1.2000 will change the trend towards more selling to move towards stronger buying levels, and the closest ones now are 1.1965 and 1.1880, respectively. On the other hand, the pair's bullish trend will not return again without testing the top 1.2200 again.

As for the economic calendar data today: The inflation reading in the euro zone will be announced. From the United States of America, the Philadelphia Industrial Index and the number of weekly jobless claims will be announced.