The EUR / USD currency pair moved back on its upward path, reaching the resistance level at 1.2233 at the time of writing, amidst stronger bulls controlling the performance.

Resumption of economic activity in the Eurozone while easing of coronavirus restrictions led to improved data results. Yesterday, data from the European statistics agency Destatis showed that coordinated inflation in Germany exceeded the European Central Bank target of “less than, but close to 2 per cent” in May.

According to the data, German consumer prices grew 2.4% year-on-year in May, faster than the 2.1% increase in April. The rate was in line with economists' expectations and was the highest since 2018. Meanwhile, consumer price inflation accelerated to 2.5 percent from 2 percent in April. The rate was higher than expectations of 2.3%.

Commenting on the results, Carsten Brzeski, an economist at ING Bank, said that with headline inflation rising, the ECB's attempt to avoid incremental talk will become more and more complex. However, headline inflation in Germany could end up hovering between 3% and 4% in the second half of this year. Marko Wagner, an economist at Commerzbank, said that since the temporary effects are largely responsible for the rise in inflation, inflation rates can be expected to drop significantly again in the coming year. In short, inflation is supposed to average 2.5% in 2021, but then it will decline to 2% next year.

On a monthly basis, the Harmonized Consumer Price Index rose 0.3 percent, as expected in May. The consumer price index rose by 0.5 percent, which was higher than the expected rate of 0.3 percent.

On the Coronavirus front, German Chancellor, Angela Merkel said that the rule that allowed the Federal government to request strict epidemiological measures in regions with high infection rates could end at the end of June, as the country has seen a steady decline in cases of emerging coronavirus in recent weeks. Merkel told reporters in Berlin that the so-called "emergency brakes" that she went through despite resistance from some state governors had "already had an effect" in flattening the contagion curve.

In this regard, Germany's disease control agency said it had received reports of 1978 new cases of COVID-19 and 36 deaths. Accordingly, a total of 88,442 people have died as a result of infection with the Coronavirus in Germany, and the country has recorded nearly 3.7 million cases since the beginning of the epidemic.

France opened vaccinations against the virus to adults of all ages starting Monday, earlier than originally scheduled, as the pace of vaccine delivery accelerated. Therefore, more than 48% of the adult population in France took at least one dose, and more than 20% took two doses, according to public health authorities. After a slow start attributed to bureaucracy and delayed delivery, France has now delivered more than 36 million doses of vaccines.

Therefore, anyone 18 years of age or older can register for an injection. Children between the ages of 12 and 15 should get access soon, too, after the European Medicines Agency authorized the use of the Pfizer vaccine for that age group last week. French Prime Minister Jean Castex said "the horizon is clear" but warned people to remain vigilant.

France has recorded more HIV infections than any other European country, with more than 109,000 deaths linked to COVID-19.

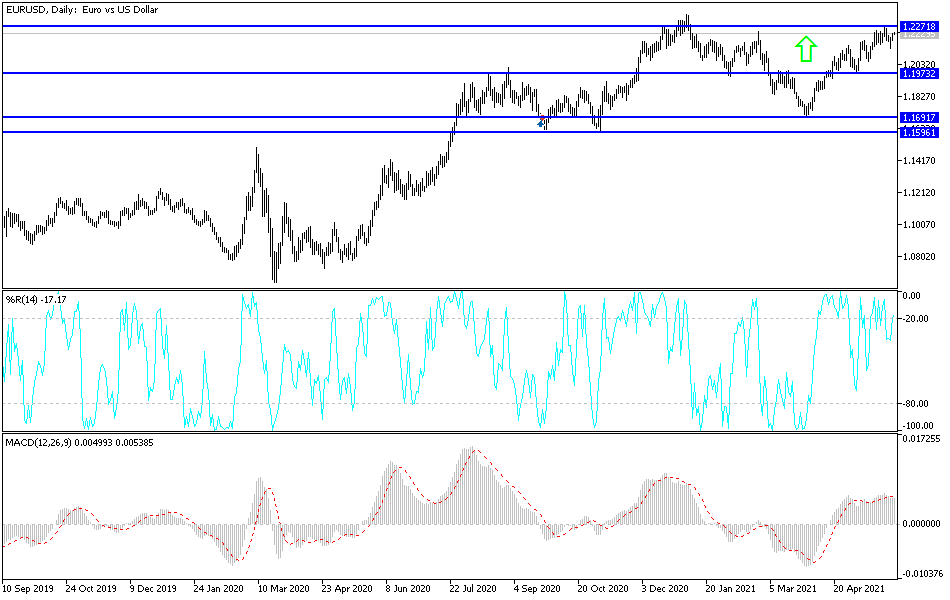

According to the technical analysis of the pair: On the daily timeframe chart, the stability of the EUR / USD currency pair above the resistance 1.2200 confirms the control of the bulls over the performance and increases the buying operations to move the currency pair to higher levels as long as optimism persists. The closest targets of the bulls are currently 1.2255, 1.2320 and 1.2400, respectively. These are levels for the technical indicators to move to strong overbought levels, which are expected to consider selling operations to reap profits. On the downside, according to the performance over the same period of time, the bears will return to dominate the performance by moving towards the support level 1.2050 otherwise the general trend will remain up.

As for the economic calendar data today: The Euro will be affected by the announcement of the Industrial Purchasing Managers' Index (PMI) reading for European economies, as well as the announcement of inflation and unemployment figures for the Eurozone. The US dollar is affected by the announcement of the US ISM Manufacturing PMI reading and construction spending.