The US dollar is still trying to achieve the largest amount of gains ahead of the announcement of influential US economic data, led by the announcement of US jobs numbers.

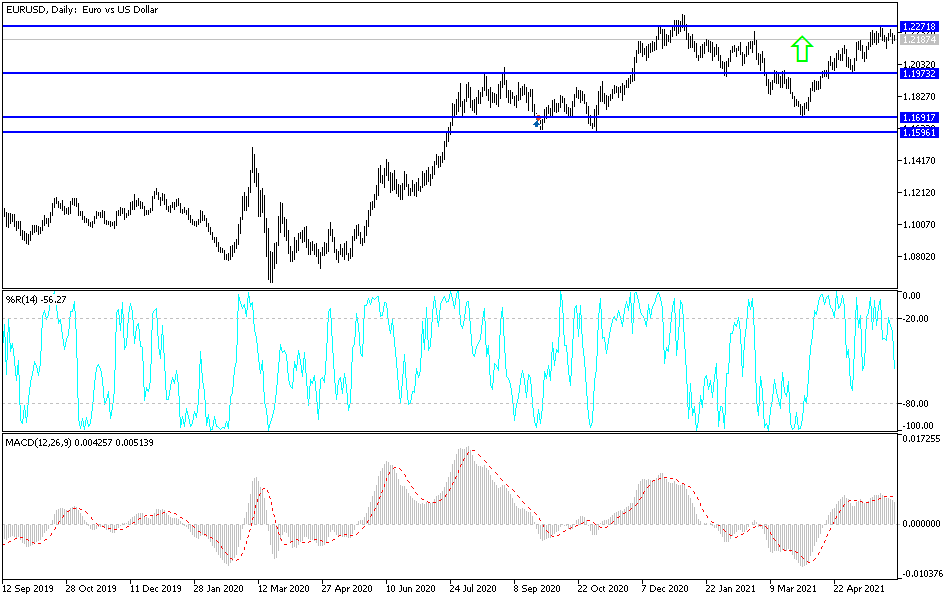

Accordingly, the price of the EUR/USD currency pair is moving under limited selling pressure. It reached the 1.2165 support level, before settling around the 1.2190 level at the time of writing the analysis. In the middle of this week's trading, it jumped to the 1.2255 resistance level. Commenting on the future of the euro-dollar, Forex analysts at Credit Suisse Bank say that the EUR-dollar is unlikely to break the 1.23 level in the coming weeks as the European Central Bank meeting in June is likely to disappoint buyers.

The EUR/USD exchange rate was unable to break the ceiling at 1.2250 in May, but with technical indicators confirming that the momentum is still largely positive, the market could make another attempt to break that level. It looks like any technical break will require either a major renewal of the US dollar's weakness or a move by the European Central Bank (ECB) to make a "tough" note at the June policy event. The June monetary policy meeting could be a watershed moment for the EUR if the ECB chooses to signal that it is now ready to tighten monetary policy and begin exiting its exceptional support program.

More specifically, this tightening will come in the form of a commitment to reduce the size of the asset purchase program (quantitative easing) on the grounds that the economic outlook has improved significantly and inflation in the Eurozone is rising.

The general rule is that such a move will prove supportive of the euro.

Meanwhile, economists at Credit Suisse issued a note saying that they expect the European Central Bank to announce a reduction in its quantitative easing program from €80 billion per month to €60 billion. They also say that this will reflect better overall conditions and will mean that they can avoid increasing the overall size of the current program.

But Credit Suisse's foreign-exchange strategy team disagrees with their colleagues in the economic research department. They say that such a hard-line view of the European Central Bank could lead the EUR/USD currency pair "to surpass our near-term target at the 2021 highs around 1.2350 to test levels around 1.2500 and above last seen there in 2018".

“This may not be a stellar look if it brings inflation expectations down materially again, especially with the release of the results of the European Central Bank’s strategic review later this year,” says Shihab Galinus, forex analyst at Credit Suisse.

In general, the appreciation of the euro is considered a deflationary force for the euro area because it reduces the cost of imports and reduces the profits of exporters in the region. Given the European Central Bank's multi-year failure to bring inflation back to 2.0% on a sustainable basis, it is no surprise that a strong euro is not welcome.

Accordingly, Galen and his colleagues maintain their expectations that the EUR/USD should peak around 1.2350 this month.

Technical analysis of EUR/USD: There is no doubt that the results of the US economic data will determine the fate of the pair for this week's closings and what it will perform next week. Now the performance is neutral with a tendency to the upside, especially if the euro dollar returns to stability above the 1.2200 resistance. This stimulates buying to move towards stronger ascending levels, and the closest ones are currently 1.2235, 1.2300 and 1.2365, respectively.

On the downside, the bears' control over the performance will be strengthened. If the currency pair moves below the support level 1.2075, the euro will be affected today by the announcement of the PMI for the services sector for the economies of the euro zone. The dollar will be affected today by the announcement of the ADP reading of the change in the number of non-farm jobs, the weekly US jobless claims, the non-farm productivity and the ISM services purchasing managers index