The EUR/USD was subjected to sell-offs during last week's trading, as it moved towards the 1.2104 support level before closing the week's trading stable around the 1.2166 level. Adding to the pair's weakness was the announcement that US job growth accelerated in May, according to a closely watched report from the Department of Labor, although the increase in employment still fell short of economists' estimates. The report said that employment in the non-farm sector in the United States jumped by 559,000 jobs in May after it increased by 278,000 jobs, adjusted upwards in April.

Economists expected the number of US jobs to increase by 650,000 jobs compared to the addition of 266,000 jobs originally reported for the previous month.

Commenting on the figures, Paul Ashworth, chief US economist at Capital Economics, noted that US employment is still 7.6 million below its pre-pandemic peak, and said it would take more than 12 months at the current pace to completely eliminate this shortage. "Just a few months ago we were expecting to see multi-month gains of over a million as the economy reopens, but labor supply is recovering much more slowly than demand," Ashworth said.

According to the announced figures, employment in the leisure and hospitality sector showed another significant increase, as it rose by 292,000 jobs during the month. Significant job growth was also observed in public and private education, health care and social assistance. The US Department of Labor also added that the US unemployment rate fell to 5.8 percent in May from 6.1 percent in April, while economists expected the unemployment rate to fall to 5.9 percent.

With a larger-than-expected drop, the US unemployment rate fell to its lowest level since it reached 4.4 percent in March 2020.

Retail sales in the Eurozone fell faster than expected in April after picking up in the previous two months, as COVID-19 lockdown restrictions were tightened in some countries. Accordingly, preliminary data from the European statistics agency Eurostat showed that retail sales decreased by -3.1 percent from March. Economists had expected a decline of -1.4 percent. In March, sales in the Eurozone grew by 3.3 percent, after adjusting for 2.7 percent.

The reason for the recent decline was a 5.1 percent drop in sales of the non-food group excluding motor fuels. Sales in the food, beverage and tobacco group decreased by 2 percent, and sales in the mail-order and Internet sector decreased by 2.9 percent. Sales of motor fuels in specialized stores grew by 0.4 percent.

In the European Union, retail sales fell -3.1 percent from March, when they rose by 3.2 percent. This was also the first fall in three months. On an annual basis, Eurozone retail sales rose 23.9 percent in April after a 13.1 percent growth the previous month, revised from 12 percent. Economists had expected growth of 25.5 percent. Sales rose for the second month in a row.

Commenting on the numbers, ING Economist Bert Cullen said: "Sales are volatile at the moment, but all signs point to a stronger recovery for the rest of the second quarter." The economist added that the end of retail reopening is an unlikely recovery as consumers spend more and unemployment continues to fall over the course of the second wave. "Add the additional savings accumulated from last year to that, and this gives a strong outlook for the retail sector for the coming months, supporting a strong recovery in consumption," Cullen added.

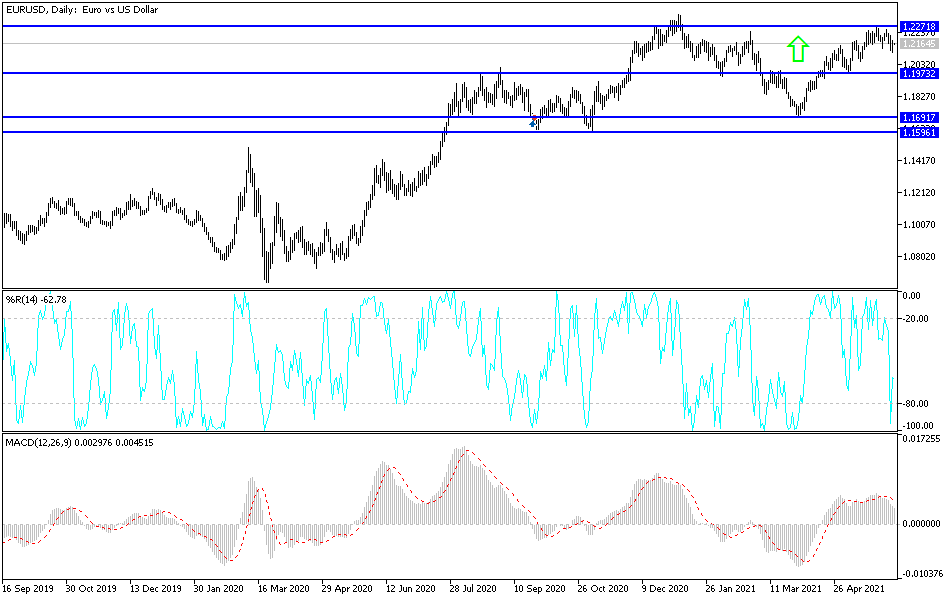

Technical analysis of the pair:

The recent sell-offs did not break the price of the EUR/USD down from its ascending channel range so far, and that will not happen without breaching the 1.1985 support level. With the currency pair approaching the resistance level of 1.2200, the general trend of the pair will remain bullish because it is the level that stimulates more buying.

The course of the currency pair in the coming days will be determined by global efforts to vaccinate and abandon the restrictions of COVID, and the positive results of economic releases, which confirm the extent of recovery from the effects of the pandemic.

German factory orders and the Sentix Index of investor confidence in the Eurozone will be announced. The currency pair is not awaiting any important US economic data today.