The US dollar is recovering ahead of the announcement of monetary policy decisions by the US Federal Reserve on Wednesday. Nevertheless, the euro has the opportunity to return its gains if the bank does not give any indications of imminent tightening of its policy.

Germany has recorded the lowest number of new daily infections with the Corona virus in nearly nine months, and officials are raising the possibility of relaxing the rules for wearing masks.

In this regard, the Robert Koch Institute, the National Center for Disease Control, said that 549 new cases of infection were reported during the past 24 hours. It is the first time since September 21 that the number has fallen below 1,000, although it is typical for numbers over the weekend to be relatively low due to fewer tests being conducted and reported. Germany has reported more than 3.7 million cases since the pandemic began. Another 10 deaths brought the death toll in the country to 89,844.

Infection numbers have fallen sharply in recent weeks and a discussion has begun about the future of mask-wearing rules. German Health Minister Jens Spahn told the Funke newspaper group that a gradual approach should be taken, with the rules for outdoor wearing first lifted. He said they could be brought down "bit by bit" indoors in areas with very low infection rates and high vaccination rates.

On the economic side, data from Eurostat showed that industrial production growth in the euro zone accelerated in April. According to the results, industrial production grew by 0.8 percent on a monthly basis in April, faster than the 0.4 percent increase in March. This was the second consecutive rise in production, which matched economists' expectations. Production of durable consumer goods increased by 3.4 percent and energy production by 3.2 percent. The production of capital goods grew by 1.4 percent and intermediate goods by 0.8 percent. Meanwhile, production of non-durable consumer goods fell 0.3%.

On an annual basis, industrial production in the euro zone rose by 39.3 percent versus an increase of 11.5 percent in March. Production was expected to increase by 37.4%. Industrial production in the 27 European Union countries rose by 0.5 percent month-on-month in April, and rose by 38.7 percent compared to the same period last year.

Commenting on the figures, Bert Cullen, chief economist at ING Bank, said that with demand continuing to emerge rapidly, the industry's outlook remains bright and appears likely to be curbed by supply-side constraints.

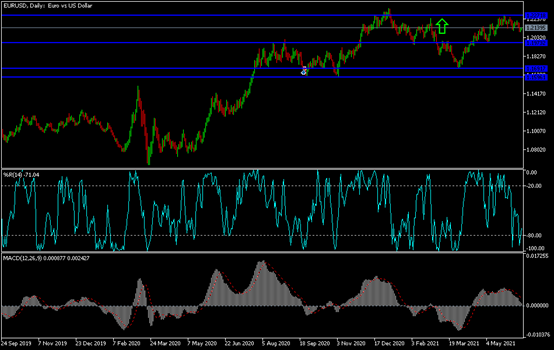

Technical analysis of EUR/USD: On the daily time frame, there is a bearish tendency for the EUR/USD currency pair, and the bears' control over the performance will increase if the pair moves below the psychological support 1.2000. On the other hand, surpassing the resistance 1.2220 will restore the bulls' control over the performance, and thus move towards stronger ascending levels. The pair may move in narrow ranges until the US Central Bank announces its monetary policy decisions tomorrow, Wednesday.

As for the economic calendar data today: The German and French consumer price index will be announced, then the trade balance numbers for the eurozone. The United States of America is the most important, with the announcement of retail sales figures, producer price index and industrial production rate.