Last Thursday’s EUR/USD signals were not triggered, as there was insufficiently bullish price action when the support levels identified were first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today only.

Short Trade Ideas

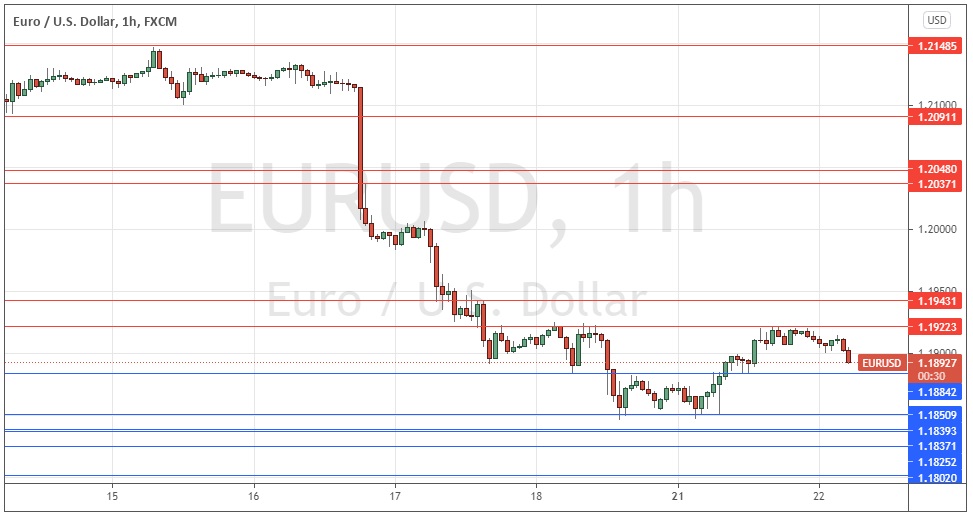

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1923 or 1.1943.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame time frame immediately upon the next touch of 1.18841, 1.1851, 1.1839, or 1.1825.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that we were seeing bearish momentum, meaning we were very unlikely to see a strong up day. I thought that if the price at 9am London time had fallen over the past hour and was below 1.1980, we would be likely to see a further fall to at least the next support level at 1.1943. This was a good and accurate call, as 1.1943 was easily exceeded while the day ended down.

After Thursday’s down day, the price fell again Friday, making a new 50-day low closing price, which is typically a bearish sign in this currency pair. However, yesterday saw a quite strong bullish pullback, but this just increased the chance that today will be a down day. So far, it is, with the price being unable to break up above the strong resistance level at 1.1922 and making a bearish double or maybe even triple top capped by that level.

The price looks likely to fall further today, with the next level to watch being the flipped resistance to support at 1.1884. If that level breaks down, the price is likely to break 1.1851. If the price ends the day below 1.1851, that will indicate that strong bearish momentum has resumed, and the long-term trend should push on to still lower prices over the coming days.

The chairman of the Federal Reserve will be testifying before the U.S. Congress at 7pm London time. There is nothing of high importance due today regarding the EUR.