Bullish View

- Buy the EUR/USD and add a take-profit at 1.2250.

- Add a stop-loss at 1.2100.

- Timeline: 1-3 days.

Bearish View

- Set a sell-stop at 1.2135 and a take-profit at 1.2050.

- Add a stop-loss at 1.2200.

The EUR/USD pair was in a tight range during the Asian session as the market reflected on the latest US jobs data and the upcoming European Central Bank (ECB) decision. It is trading at 1.2163, which s 0.50% above the lowest level on Friday.

ECB Decision Ahead

The biggest mover of the EUR/USD this week will be the upcoming ECB interest rate decision that will come out on Thursday. The decision comes as recent numbers show that the Eurozone economy is doing relatively well. Consumer and business confidence has jumped to the highest level in three years, while inflation has risen to the ECB target of 2.0%.

Still, the ECB is expected to leave interest rates and its pandemic purchases - quantitative easing - unchanged. According to Bloomberg, the members will likely say that the recent economic numbers like inflation are transitory as the economy emerges from the pandemic. Also, the members will likely point to a slew of weak data from Europe like the recent French Q1 contraction.

The EUR/USD will also be affected by Friday’s employment numbers from the United States. The data showed that the American economy added 559k jobs in May, lower than the ADP estimate of 950k and the median analyst prediction of more than 700k. The data show that the economy has 7.3 million fewer jobs than before the pandemic started.

The numbers were in sharp contrast with what is happening in other sectors of the economy. Consumer spending has rocketed higher, helped by the services sector. Similarly, the inflation rate has jumped to the highest level in years while consumer confidence has also jumped.

The economic calendar will be relatively muted today. The only data to watch from the Eurozone are the German factory order numbers, Spanish industrial production, and the Eurozone investor confidence.

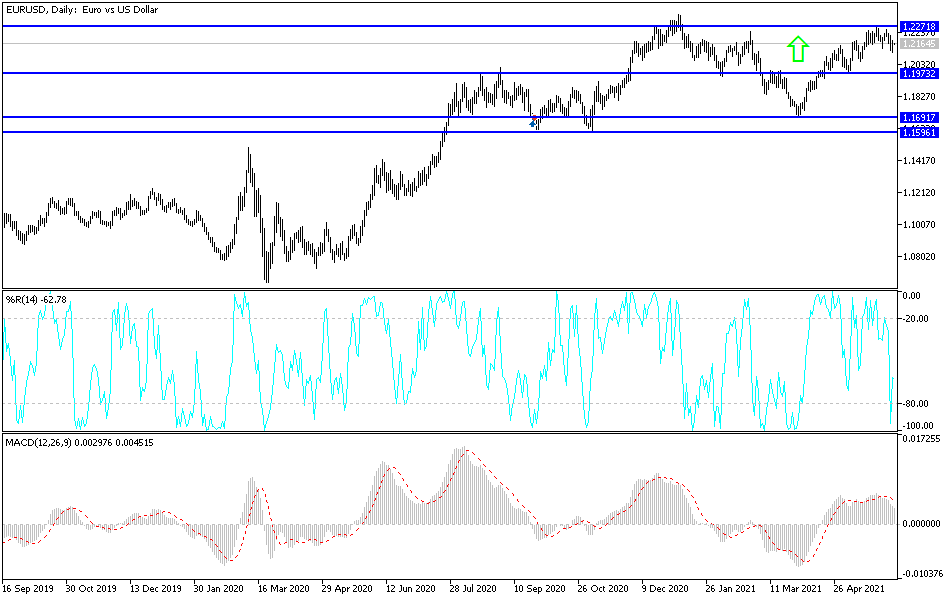

EUR/USD Technical Outlook

The EUR/USD pair is trading at 1.2165, which is substantially higher than last week’s low of 1.2100. On the four-hour chart, the pair is trading at the 25-day and 15-day exponential moving average (EMA). It is also slightly above the neckline of the head and shoulders pattern at 1.2135, while the Stochastic oscillator has moved close to the overbought level of 75. It also seems to be forming a bullish flag pattern. Therefore, the pair will likely keep rising as bulls target the next key resistance at 1.2250.