Last Thursday’s EUR/USD signals were not triggered, as none of the identified key levels were reached that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken prior to 5pm London time today.

Short Trade Ideas

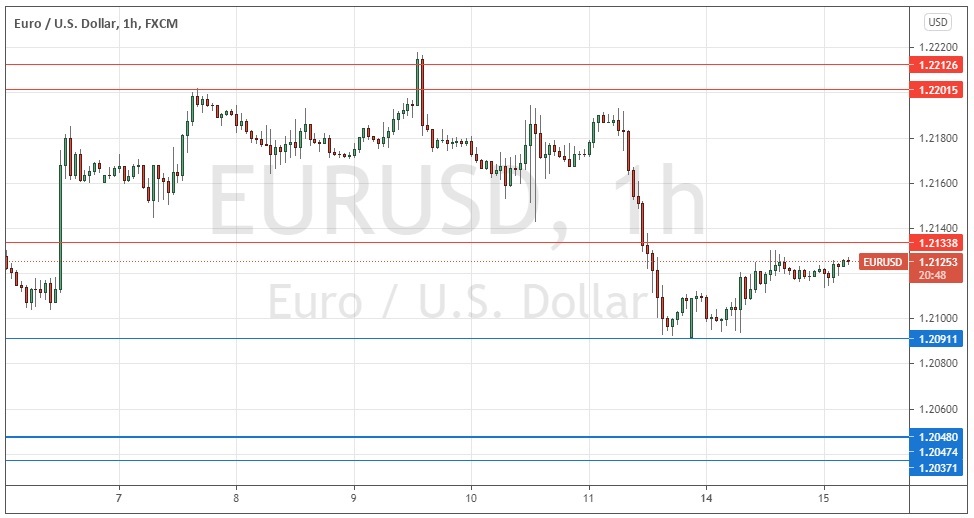

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2134, 1.2202, or 1.2213.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2091 or 1.2048.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that the best approach to trading this pair should wait for the ECB release and then trade reversals from any spikes to extreme levels, and then to closely monitor any trade into the U.S. data release due not long after that.

I also noted that the fact that the price seemed to have formed a distributive top near 1.2240 over many days, which suggested that we were more likely to see a breakdown than a breakout. I thought that a technically significant breakdown will happen if the price can get established below 1.2091.

These were good and accurate calls, with the ECB release causing a spike and the price going on to break down later. However, the support level at 1.2091, as expected, has held.

The technical picture now is one of a bullish recovery from the bounce at 1.2091 running into resistance at 1.2134. It is important to note that this level at 1.2134 is not very precise and the resistance is likely to run up to 1.2150.

The euro is one of the stronger major currencies right now, so there is a good chance we will see the price break up above 1.2150 later today. If the price can get established above that half-number, it has room to rise further, so short-term long trades following two rising consecutive hourly closes above that level should be the way to trade this currency pair today.

Regarding the USD, there will be a release of Retail Sales and PPI data at 1:30pm London time. There is nothing of high importance scheduled for release concerning the EUR.