The Euro has broken down significantly during the course of the trading session on Thursday as the trading world continues to see the question of inflation become most of the moves. The CPI numbers came out early during the trading session in New York on Thursday, which were much hotter than anticipated. However, it is still very likely that the Federal Reserve is nowhere near trying to tighten or taper monetary policy, so as a result we have seen the Euro turnaround after the initial selloff.

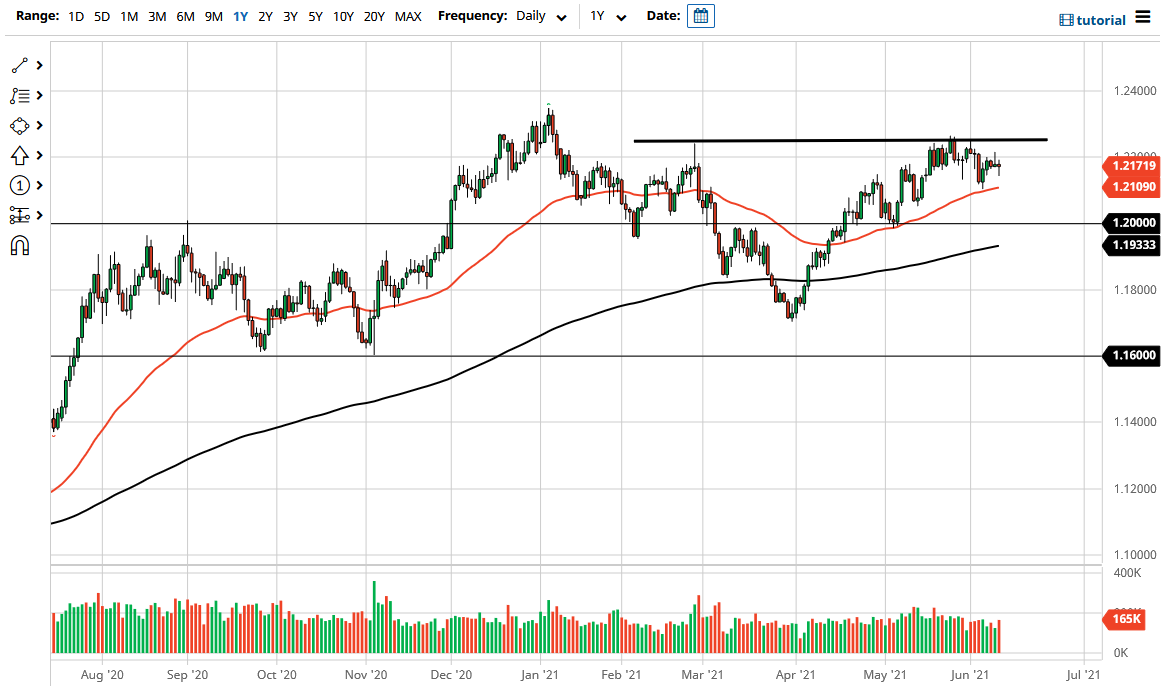

The resulting candlestick is of course a hammer, which was preceded by a shooting star. This typically means that you are about to enter an area of choppy behavior and back-and-forth trading, which of course is the natural domain of the Euro anyway. The 50 day EMA underneath continues offer support, which is at the 1.21 handle, and as a result I think that is probably the short term support. To the upside, the 1.23 level offer significant resistance, and I think at this juncture the 1.23 level is going to be very difficult to get beyond. This is because there are no real catalysts to move the marketplace right now, and it is all about the Federal Reserve at the end of the day. I do think that the market is ready to come back to the idea of the overall uptrend, but we may have a short-term pullback in the meantime in order to find buyers.

Underneath, the 1.28 level is a major “floor the market”, so if we were to break down below there then I think the Euro would find itself in trouble. That is not my best case scenario, I think we just simply kill time for a while, much like we are seeing in the Australian dollar. With that in mind, if you are a short-term trader this might be the best way to trade the market, perhaps off of the 5 or even the 15 minute charts. Because of this, I probably will be trading at, but I would look at this pair as a potential indicator for US dollar strength in general to trade other pairs. I will want for some type of break out but do not expect to see it anytime soon, let alone heading into a weekend.