The euro rallied significantly during the trading session on Wednesday as we await the CPI figures on Thursday. With that being the case, the market looks as if it is simply trying to stabilize itself in the short term, until we get some type of sign of where inflation is going due to the announcement.

The euro has been trying to get to the 1.23 level, an area that I think opens up the possibility of a move all the way to the 1.25 handle longer term. After all, the 1.25 level is a large, round, psychologically significant figure that has quite a bit of influence on longer-term charts. Beyond that, there are a lot of analysts out there who believe the euro will try to get there sometime between now and the end of the year. Because of this, I think there will be a “buy on the dip” mentality out there. The candlestick for the trading session is a bit of a shooting star, but I think that is probably more indicative of the position closing later in the day.

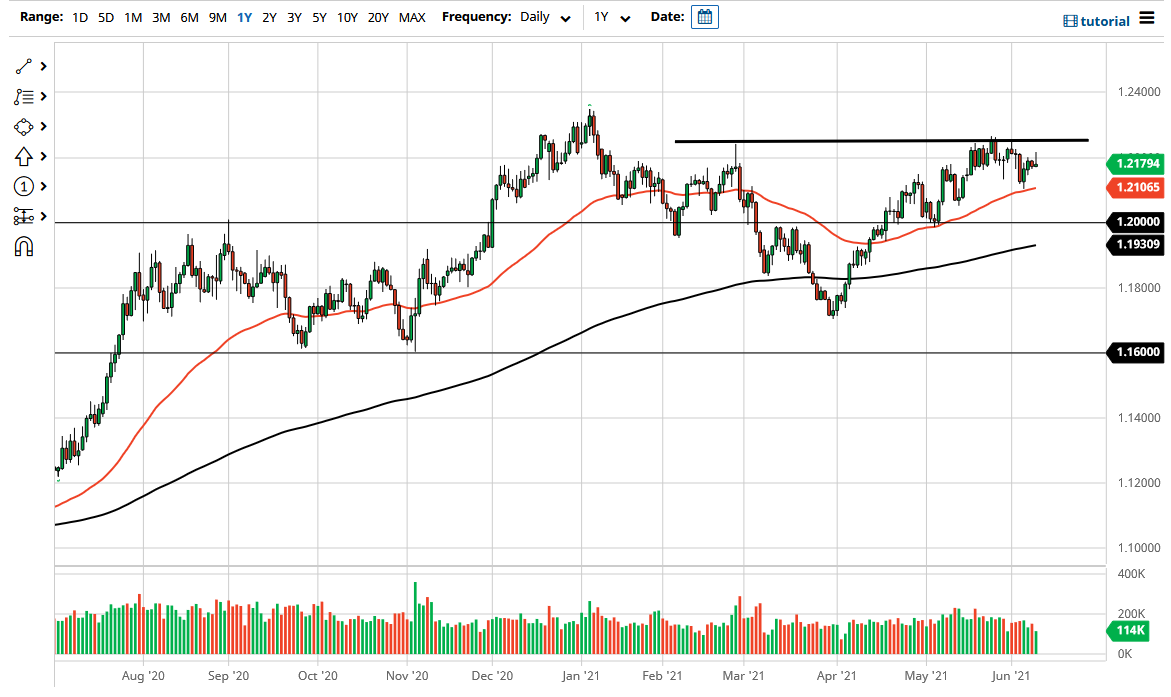

If we do break down from here, I believe that the 50-day EMA will come into the picture as support, looking at the 1.21 handle. The 1.21 handle is an area that we bounced from previously, so I think that given enough time it could offer itself as a “floor in the market.” In the short term, though, the floor is probably closer to the 1.20 handle, as we have seen psychological and structural importance applied to that level in the past. Furthermore, the 200-day EMA is grinding higher and looks very likely to meet up with the 1.20 handle if we do reach down towards it. With this being the case, I do not have any interest in shorting this market anytime soon, unless we break down below that level, because then it would have made a statement that it is going much lower. I anticipate that a short-term pullback would only offer value that people are more than willing to take advantage of, so I anticipate a snapback if we get a selloff.