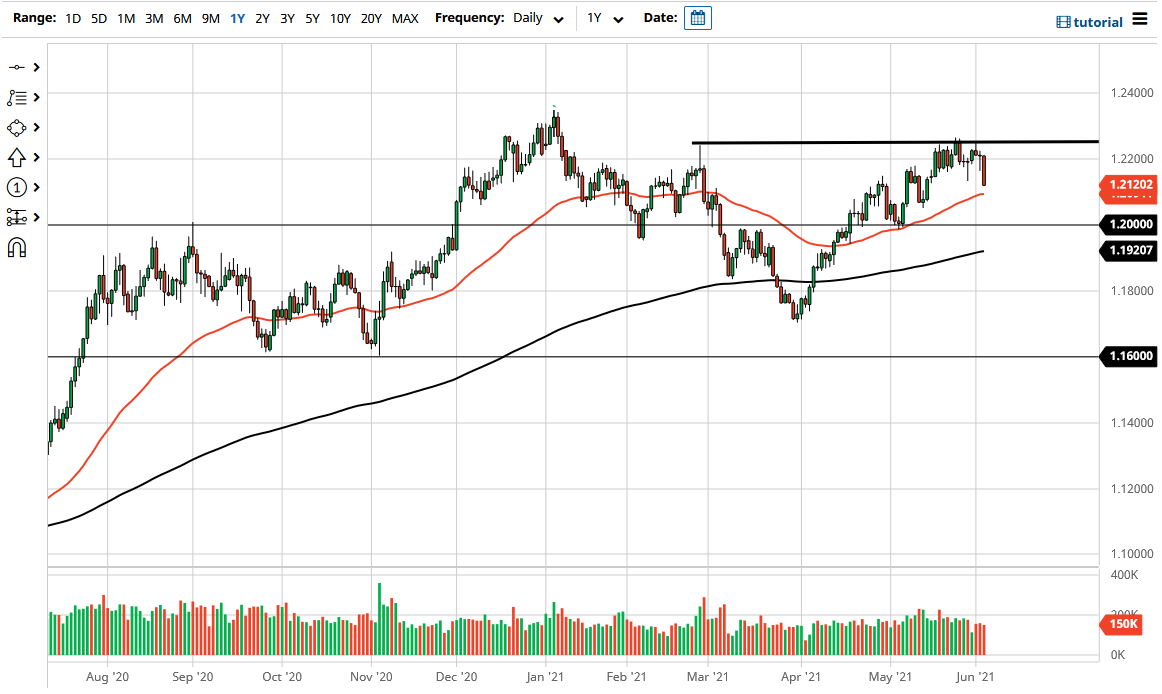

The Euro fell apart during the trading session on Thursday as the Initial Jobless Claims came in under at 400,000 in America, having people freak out that the Federal Reserve might actually taper sometime soon. At the end of the day, they are nowhere near doing so, because interest rates can only rise so far before the Federal Reserve will have to do something. With that being the case, I think that this will end up being a nice buying opportunity in this was more or less a “tantrum” being thrown by Wall Street more than anything else.

To the downside, I believe that the actual “floor in the market” is at the 1.20 handle, and therefore it is going to be difficult to break down below there. If we get anywhere close to that level, then it will more than likely end up being a nice buying opportunity that we can take advantage of. Keep in mind that the Friday session of course is the jobs figure in America, and that causes all kinds of volatility and havoc. Nonetheless, I do think that will change much in the long term, but in the short term it could cause all kinds of trouble.

To the upside I believe that the 1.23 level is major resistance and breaking above that level opens up the possibility of a move towards the 1.25 handle. If we can get up to the 1.25 handle, then it is likely that we will see a significant amount of resistance as it is a large, round, psychologically significant figure. The market will continue to look at the area as important due to its previous reactionary pressure, and of course the fact that the Euro has a lot of pundits talking about a hitting that level sometime this year as a target. Whether or not we can break above there might be a completely different question, but at this point it is likely that we will see an attempt to get there by the end of summer or early fall. Obviously, that has a long way from here and that does make sense considering that the market tends to chop back and forth more than anything else. I would look at a significant pullback as a potential buying opportunity in a strong uptrend.