The euro got absolutely crushed during the trading session on Wednesday as the Federal Reserve came out and suggested that inflation was running a bit hotter than originally anticipated. Now it makes sense that we would see the Federal Reserve step in and raise interest rates quicker than recently expected.

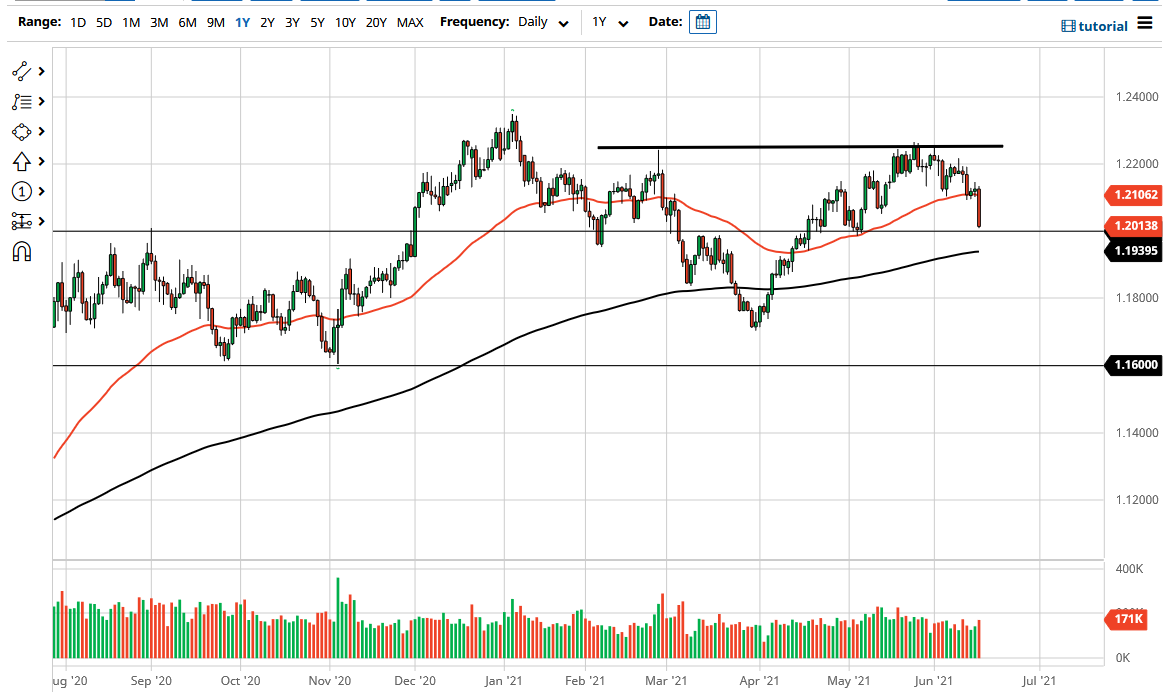

That being said, I think it is a bit of a stretch at this point to think that things have dramatically changed, and this may end up being thought of as a significant overreaction by the market. We simply need to wait and see what happens next as the market could turn around and correct rather quickly. Because of this, I think you need to be very cautious about your position size, and I think it is probably best to leave this alone in the short term. Underneath, we have the 200-day EMA which is at the 1.1939 level, which will attract a lot of attention.

Ultimately, the fact that the market is closing at the very bottom of the candlestick does suggest that we may have an even deeper test of support, and it could very well cause a little bit of a run. If we do break down below the 200-day EMA, then it is possible that we could see a rather strong selloff, perhaps reaching down to the 1.18 handle. Ultimately, this is a market that I think continues to see a lot of noisy behavior over the next couple of days from everything that I see, so it is worth paying close attention to as it could give us an idea as to what the US dollar will do in general.

At this point, I think we will continue to see a lot of uncertainty when it comes to what the Federal Reserve is about to do, as they have dropped the ball yet again on communicating what is coming next. Because of this, we will more than likely continue to see more of a grind back and forth, and the fact that it is summer certainly will not be helping the situation either. Because of this, caution is by far the biggest thing that I would suggest here, but it must be noted that this candlestick is horribly negative.