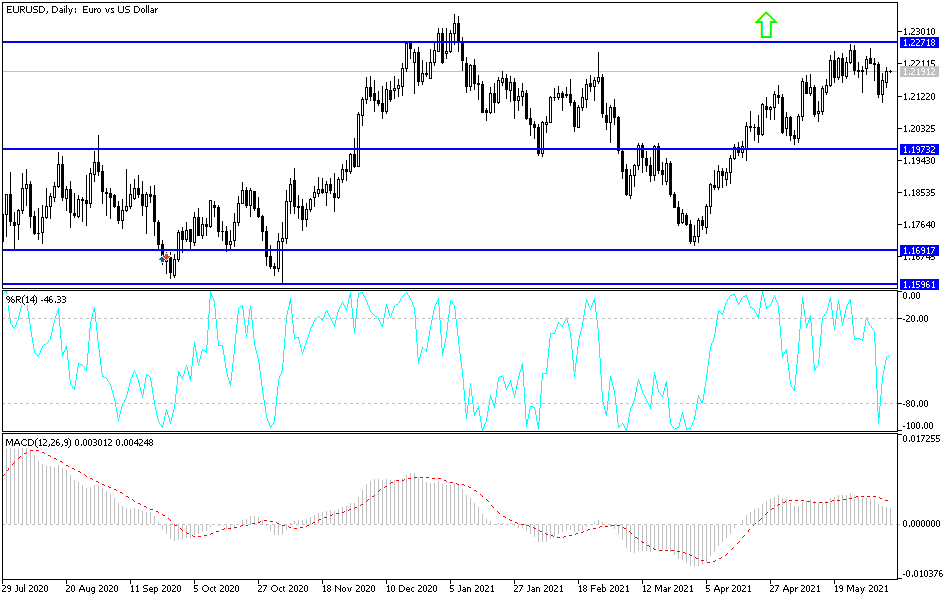

The euro rallied significantly during the trading session on Monday to reach towards the 1.22 handle. That is an area that is somewhat important, but what it is worth paying attention to is that there is a lot of selling pressure between here and the most recent highs. If we can get above there, then we have the possibility of looking towards the 1.24 handle, and then eventually the 1.25 level which is my longer-term target.

The US dollar has been hammered due to spending and concerns about inflation as well, so it is likely that we will see a lot of US dollar selling in general, as we have seen in multiple other currency pairs. That being said, the market is likely to see the recent highs as very difficult to get above, and I think that a lot of people will be paying close attention to the CPI figures on Thursday, as it will give us an idea as to whether or not inflation is picking up in America.

Looking at the bond markets, the German bond yields have been rising ever so slightly, working against the “sell the euro” narrative. Nonetheless, I do think that there is some type of pullback that we can start buying, especially near the 50-day EMA. The 50-day EMA is sitting at the 1.21 handle, which is an area where we have seen a bit of action more than once. Ultimately, this is a market that I think will continue to try to build up enough pressure to finally break out, but I think we will probably have a lot of back and forth between here and the end to get the final breakout.

If we were to turn around and break down below the 1.20 handle, then it is possible that the 200-day EMA could come back into play and offer plenty of support at that region and big figure. It is likely that we will see more of a grind and a “buy on the dip” type of market on short-term charts. With this being the case, it is very likely that the selling of this pair is almost impossible to deal with anytime soon, as there are far too many reasons to think that the US dollar will continue to struggle overall.