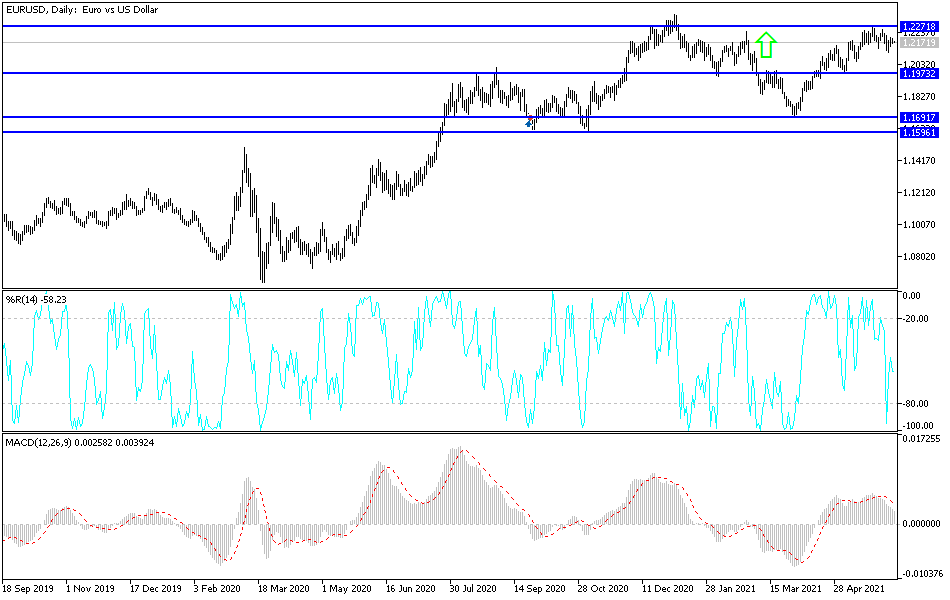

The euro drifted a little bit lower during the session on Tuesday, but at the end of the day we are running out of momentum. The CPI figures coming out on Thursday in the United States will potentially be a driver of the market going forward, but at this point it looks like we are simply shifting back and forth in a lack of direction. The 50-day EMA underneath is rising, and is technical support. It is because of this that if the market breaks down below there, I think we could go looking towards the 1.20 handle underneath, which is a large, round, psychologically significant figure. I would anticipate a lot of support there, but breaking below the 50-day EMA almost certainly could accelerate the downside a bit.

To the upside, I believe that the 1.2250 handle continues to be resistance, but just in the short term. If we can break above there, the 1.23 level is a target, and if we could break above there, then it is likely that the market could go looking towards the 1.25 handle. I think that we eventually will do that, but it may take some time to get there. The CPI figures coming out on Thursday could move this market in either direction, so be aware of that. If there is significant inflation in the United States and it appears that the Federal Reserve has to tighten sooner than anticipated, that obviously could change everything. However, if the CPI misses, then it is very likely that the euro could go higher.

I think the one thing you can probably count on is a lot of choppy behavior, as the market tends to chop around anyway. The euro is probably one of the worst pairs to trade when it gets like this, because it is simply a matter of going back and forth without any type of major move. However, eventually we will get some type of catalyst to get moving, especially if we get an impulsive candlestick. With this, I like the idea of trading the short term and range-bound more than anything else, but not with any significant amount of money, as the chop is the normal behavior of the market. This is a great way to gauge US dollar strength or weakness if nothing else.