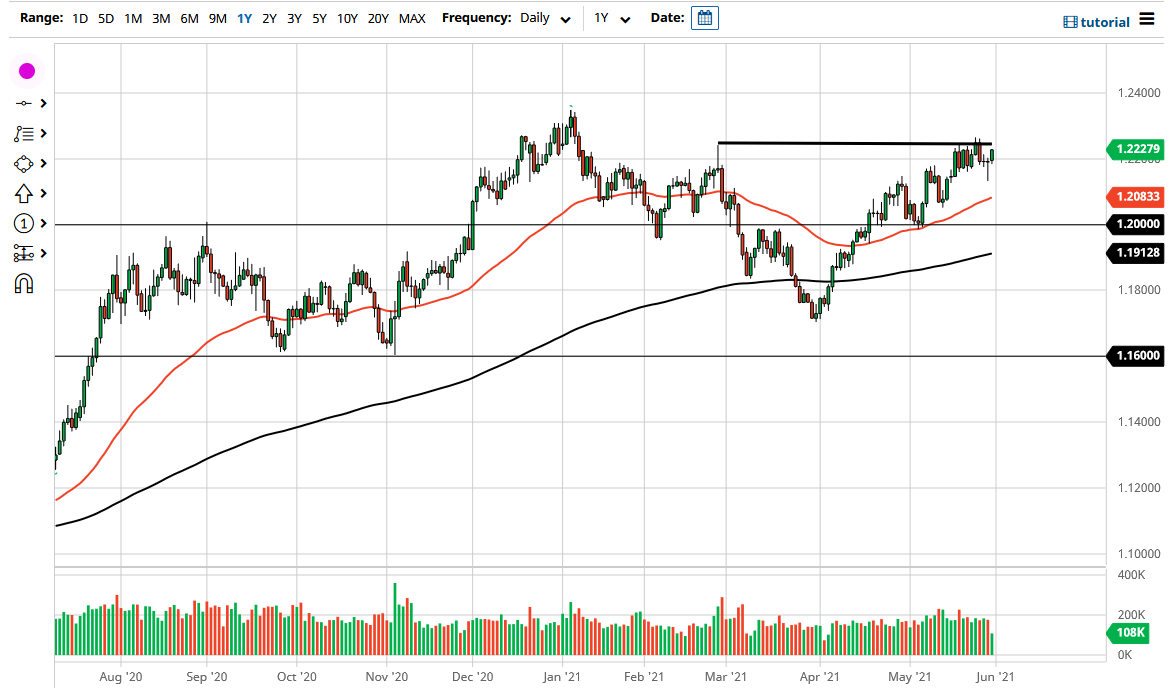

The euro rallied a bit during the trading session on Monday, but it should be noted that the Americans were not there due to the fact that it was Memorial Day. Nonetheless, the 1.23 level continues to be an area that the market is aiming towards, as it was a major resistance level previously. In the short term, I think that pullbacks will continue to be buying opportunities that people are trying to take advantage of.

The 50-day EMA is starting to approach the 1.21 level, adding more credence to the support that it has offered over the last couple of days. The hammer on Friday was very impressive and it was something that was seen against the US dollar in multiple currencies. In other words, I do not even know that this has a whole lot to do with the euro, and perhaps has more to do with the greenback. As long as there are concerns about US spending, the greenback will continue to suffer and, by extension, we will probably see the euro strengthened as it is the “anti-dollar.”

All that being said, if we were to break down below the hammer on Friday, I think that the 50-day EMA will come into focus, and if we were to break down below it, that could be a rather negative sign in order to send this market down towards the 1.20 level. The 1.20 level is an area that a lot of people have been paying attention to for a while, so I think what we are looking at is a potential trend change if we were to bust through it to the downside. I do not necessarily think that will happen, but it is something that would be worth keeping in the back of your mind.

Long term, I would anticipate that this market should go looking towards the 1.25 handle, and it is also probably worth noting that most analysts seem to agree with this being the target by the end of the year. The pair does tend to be noisy though, so it is not going to go anywhere quickly, as the euro is simply far too choppy and inhabited by far too many high-frequency traders to allow that to happen without some type of incident. As things stand, I am more of the “buy on the dip” variety of trader.