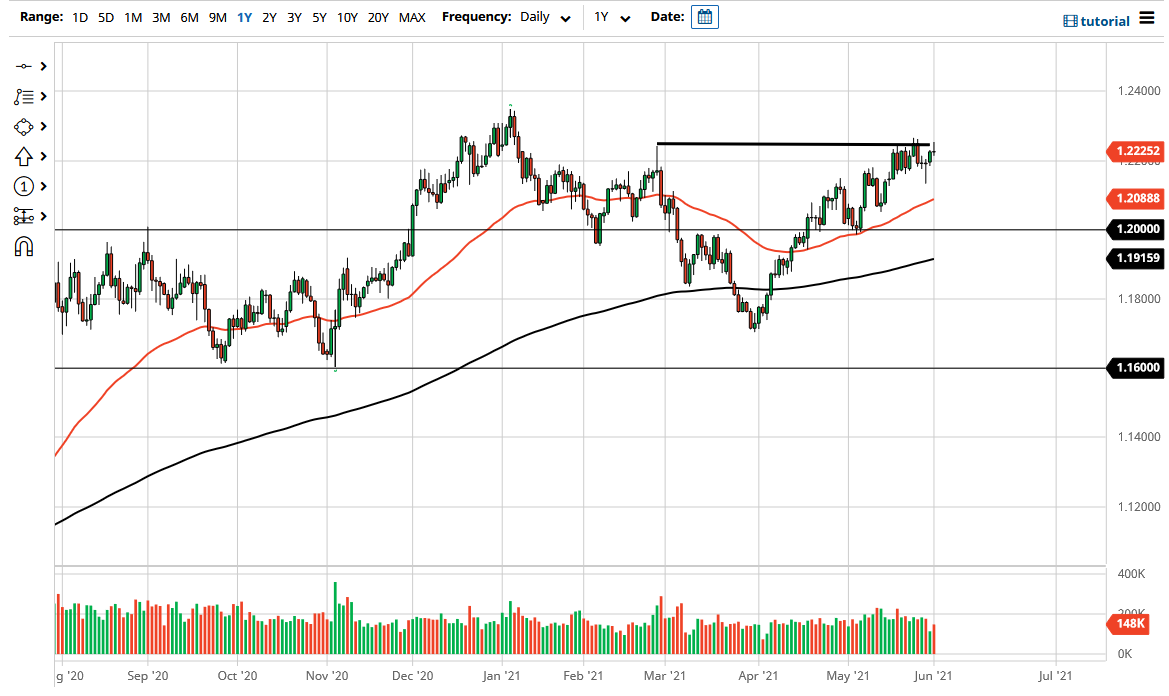

The euro initially tried to rally during the trading session on Tuesday but has failed again at the 1.2250 level. At this point, the market looks as if it needs to work quite a bit and, with the jobs number coming on Friday, I do not necessarily think that we will go anywhere. We may be entering a very choppy and sideways market, meaning that the trading is left to the short-term hyper-scalpers more than anything else.

Underneath, the 1.2130 level looks to be somewhat supportive, just as the 50-day EMA will be. However, I do not think that we have the momentum to even get there. As we get through this week, things will get worse, as the market will have nowhere to be between now and Friday. In fact, I fully anticipate that by the time we are done trading on Friday, this market will have gone nowhere. This is setting up to be one of those typical non-farm payroll Friday sessions that sees a lot of choppy back and forth behavior only to end up with a neutral candlestick.

If we can break out above the recent consolidation area, then it is likely that we could go looking towards 1.23 level, followed by the 1.25 level. That is my longer-term target, but it would not surprise me at all to see this pair take the rest of the year to make those 250 pips. All one has to do is look at how this pair behaves over the longer term to see just how choppy and sideways it can be at times.

Traders have no idea whether or not inflation is going to be real or simply “transitory.” That would be the first decision that people would have to make, and I believe that will continue to cause a lot of “push/pull dynamics” in this market going forward. Because of this, I do not necessarily have an opinion on this pair other than to trade it sideways on something like a five- or 15-minute chart. Between now and Friday, I will have to see if we get any type of significant move, but I am not holding my breath at this point. Further evidence of this potential is the fact that most of the move seems to be made in a very short amount of the trading session.