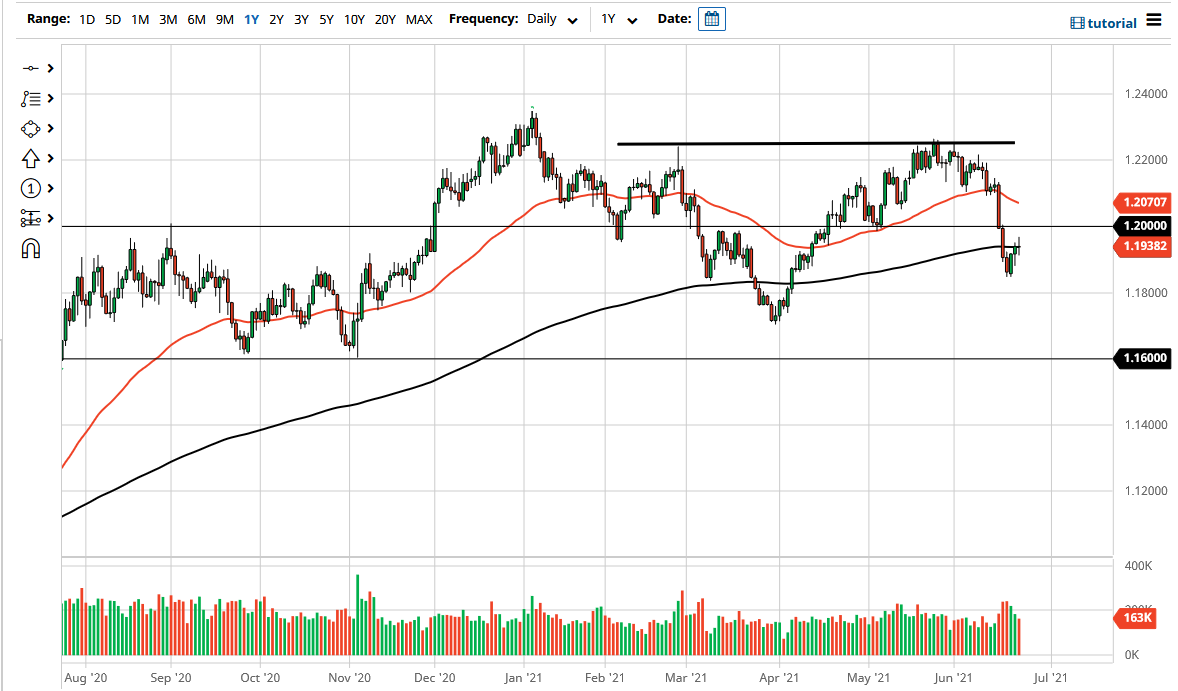

The euro fluctuated during the trading session on Wednesday as we continue to hang around the 200-day EMA. Ultimately, the market is trying to gauge whether or not the concerns about the Federal Reserve tightening will continue to shudder through the marketplace, or are we going to become quite a bit more “risk on” going forward? This is a market that has a lot to think about as the 200-day EMA does tend to attract a lot of attention, and we have significant resistance just above.

Underneath, we have a lot of support as well, so I think what we are looking at here is a scenario in which the euro is probably going to grind back and forth until we get some type of impulsive move that tells us in which direction the market is actually going to head. Right now, I believe that the 1.20 level above will attract a certain amount of selling, if for no other reason than psychology coming into the picture. To the downside, if we were to break down below the lows of Friday and Monday, then it opens up the possibility of a move down to the 1.18 handle, possibly even the 1.17 level after that.

Because of this, I believe this will continue to be a very short-term back-and-forth choppy type of situation, as the euro pair typically is. If we do break above the 1.20 handle, then it is likely that the market could go looking towards the 1.21 handle, maybe even the 1.22 handle after that. To the downside, if we do break down towards the 1.17 level, giving that up to the sellers would probably open up the possibility of a move down to the 1.15 level after that.

I think one thing that you can probably count on is that this market is going to be noisy, so with that in mind, I believe that you should probably focus on short-term charts with more of a neutral bias in the next couple of days, waiting to see whether or not we get a break of one of those much more major levels that I have mentioned previously. If we do not, then it is just going to simply be more back-and-forth scalping as per usual in this pair.