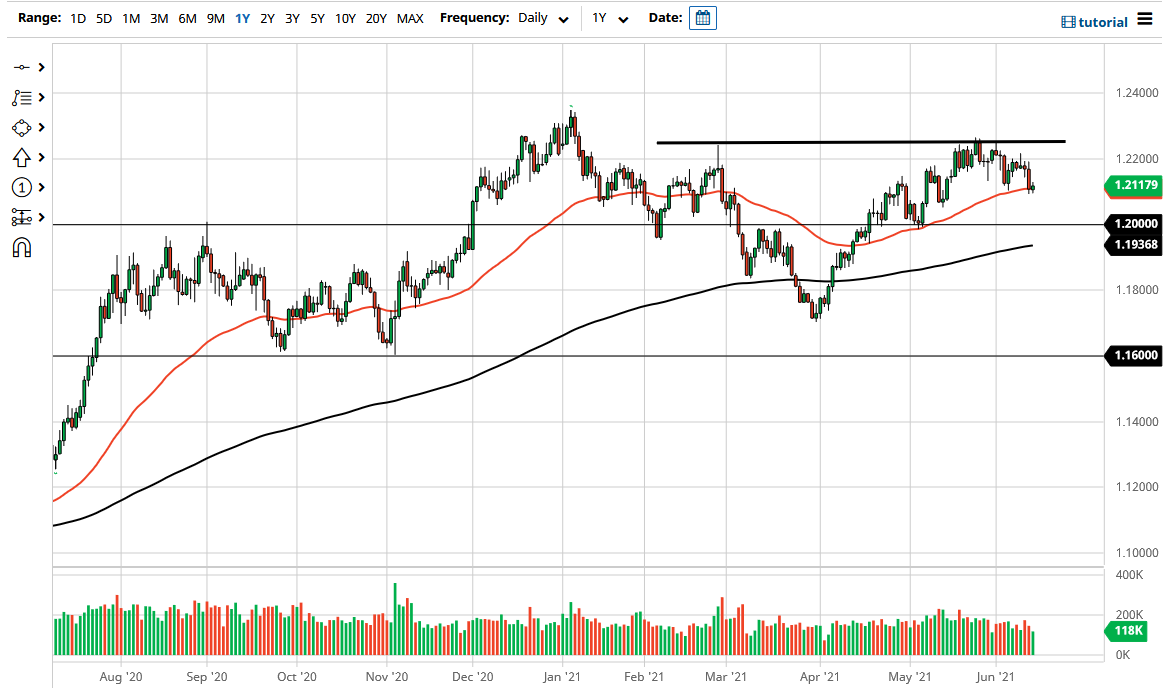

The euro did very little during the trading session on Monday, as we essentially are simply sitting at the 50-day EMA and trying to find some direction. The 1.21 level sits just below the 50-day EMA, so it is worth noting that there is a certain amount of short-term psychological importance. If we break down below the 1.21 handle, then it is likely that we will go looking towards the 1.20 level underneath, which is an area that would attract a lot of attention in and of itself.

To the upside, the 1.23 level is an area that has been massive resistance and should continue to be so. In fact, we have not been able to reach that level this last attempt but have gotten relatively close. If we break out to a fresh, new high, then it is likely that we will eventually go looking towards the 1.25 handle, which would be my longer-term target if the US dollar continues to fall overall. However, it is worth noting that more money is flowing into the US bond market, so that naturally does drive up the possibility of the US dollar strengthening again.

When I look at this chart, it is hard not to notice a bit of a “rounding top” being formed, and it should be noted that the US Dollar Index is at extreme lows and sitting right on top of pretty significant support. As the euro is such a large part of the US Dollar Index, it makes sense that we would in fact see a bit of back and forth between the two charts when it comes to leadership.

Keep in mind that the European Union is running a little bit behind the United States, meaning that they reopened a bit later. As things stand right now, the European Union continues to show signs of strength in the equities markets, with such places as Germany and France showing strong gains as of late. Because of this, one would have to think that there could be a bit of a bounce coming, but the chart certainly does not look as convincing. I think we may get a short-term bounce, but keep an eye on the 1.22 handle, because if we cannot retake that level, that would be a sign that the sellers are starting to truly build up pressure.