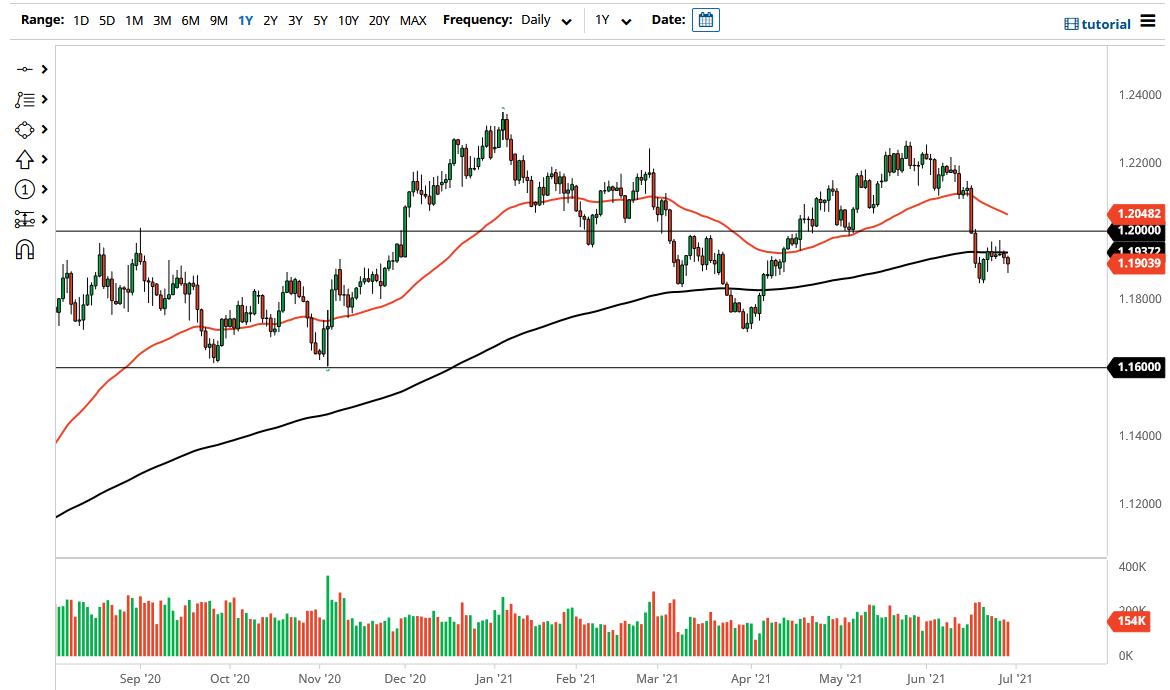

The euro has fallen a bit during the course of the trading session on Tuesday to pierce the 1.19 level to the downside. We have recovered that a bit towards the end of the day, but at the end of the session we ended up forming a bit of a hammer. So, we could stay within the range, especially as the 200 day EMA sits in the same area just above, so as it flattens out, I think this suggests that the market is not quite ready to break down completely. That being said, I do think that there is a lot of back and forth in this area just waiting to happen, and the fact that the jobs number comes out on Friday does very little to change that possibility as well.

Looking at this chart, you can see that the most recent low is just below the candlestick of the trading session on Tuesday, so if we take that out it is likely that we could go looking towards the 1.17 level, and then possibly even the 1.16 level after that. This is a market that certainly looks as if it is on the precipice of something bigger, and at this point I would have to suggest that selling probably is the most likely of scenarios.

Keep in mind that the US dollar has been strengthening against multiple currencies, not just the euro, so I think at this point in time it is likely that we are going to see a lot of choppy behavior heading towards the jobs report on Friday. Because of this, the market is likely to continue to be very noisy, but I think that we still have a lot of downward pressure just waiting to happen, as we have seen a lot of it above the 200 day EMA. In fact, it is not until we break above the 1.20 handle that I think the euro becomes bullish again, and although we did recover quite nicely towards the end of the session, it should also be noted that it was essentially just when the Americans were trading, not necessarily the rest of the world. The Americans are notorious for selling the greenback, so whether or not this can stick could be a completely different question, so keep that in mind.