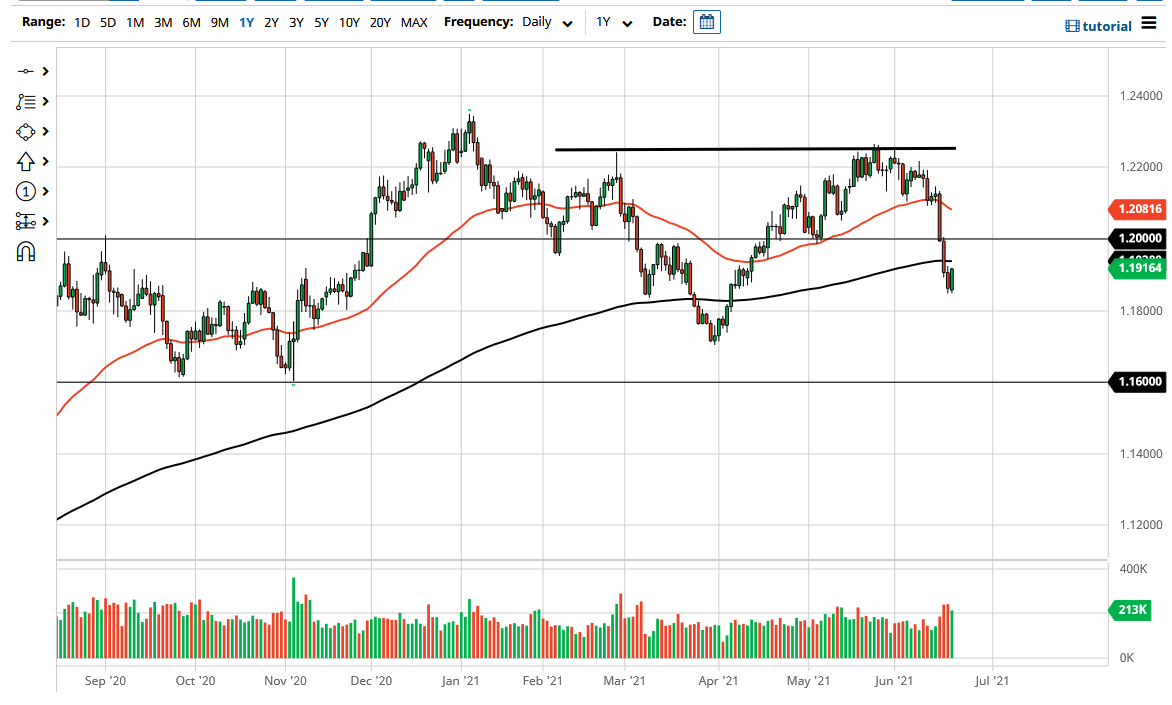

The euro rallied a bit during the trading session on Monday to recover quite nicely. As we are closing out towards the top of the range for the session, it does suggest that we are going to continue to see a significant amount of bullish pressure, but that 200-day EMA could cause a little bit of technical resistance. However, if you look at the end of April, you can see that we dipped below the 200-day EMA back then only to recover again.

Ultimately, this is a market that I think continues to see a lot of volatility, but at this point it looks like we are a bit oversold. If we do break out above the 200-day EMA, the next stop would be the 1.20 handle, an area that will attract a lot of attention. If we did break above the 1.20 handle, then it is possible that we would go even higher, perhaps reaching towards the 50-day EMA. On the other hand, there is the possibility that Powell does something to mess up the works, sending the market much lower. If we break down below the candlesticks for the last couple of days, we could then see this market move towards the 1.17 level underneath.

Keep in mind that this pair is highly sensitive to the attitude of the US dollar in general as the euro is considered to be the “anti-dollar.” Because of this, the market is more than likely going to be very noisy, especially as Jerome Powell speaks in front of Congress during the trading session. Ultimately, we will have to make a significant amount of decisions in this general vicinity, so I think that the market will be very volatile, but by the end of the next couple of sessions we should have plenty of clarity. One thing is for sure: if the US dollar does calm down a bit, this will be a fairly big move forward. This may be the same if we fall as well, as this market is paying close attention to the possibility of higher rates in the United States, which have calmed down. As money adjusts, we will have to pay attention to the differential between German and American yields.