For what it is worth, we have recovered a little bit towards the end of the session, but it certainly looks very precarious at this point. The Federal Reserve has scared everybody in the markets by suggesting there might be tapering sometime in the next couple of years, so it seems as if a lot of algorithmic trading has stepped in and caused chaos.

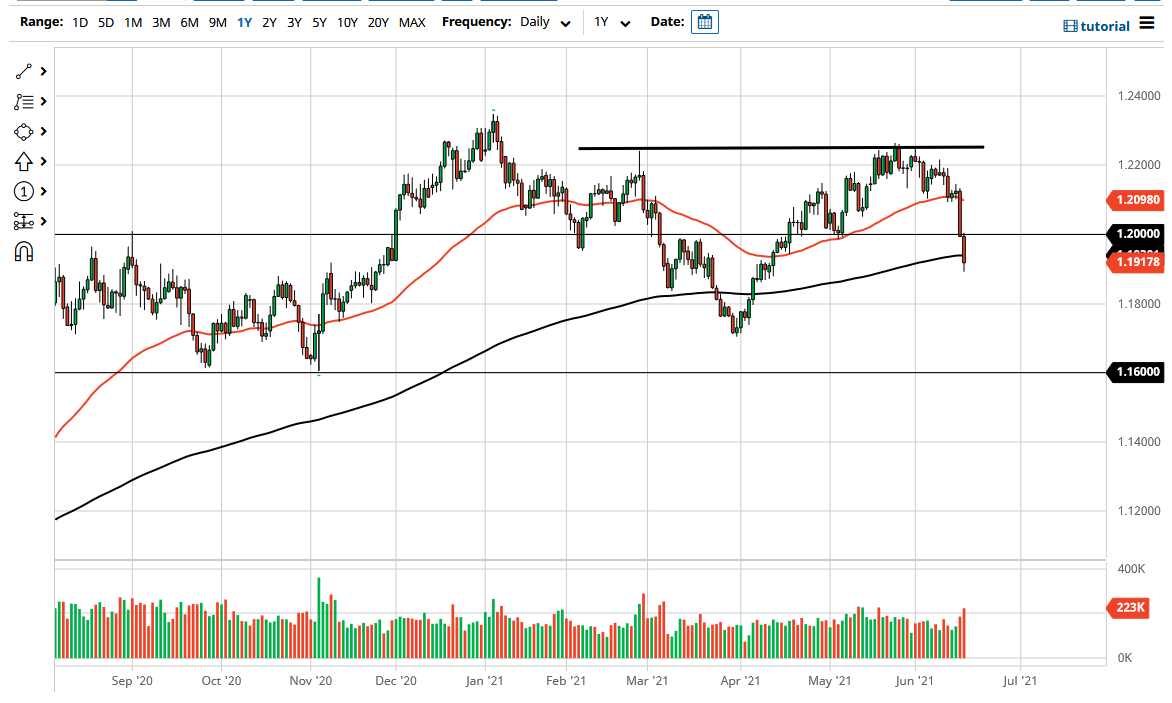

The 1.20 level of course was an area that was important, but the fact that we closed that the very low of the range from the Wednesday session would have suggested that we are probably going to break down a bit. Now that we have, it is very likely that we would see this market pay close attention to the 200 day EMA, and of course the 1.19 level underneath. All things being equal, it will be interesting to see if the 200 day EMA is respected, but so far, we have pierced the below there. It does look like we are trying to recover a bit late in the session, so I think that Friday could be a very interesting day. If we recover the 1.20 handle to the upside, then I think we will see a continuation of the market going higher.

However, if we break down below the 1.1875 level, then we could drop another 100 pips. It will be interesting to see how this plays out, and it does look very negative, but I think Friday could be a turnaround as we do not typically see this market move that far without at least some type of backup. Having said all of that, I have no interest in trying to catch a falling knife, but if we close the Friday session above the 1.20 handle, then I might get long.

Looking at the last two candlesticks, it will be interesting to see whether or not the buyers can come back in and pick things up, but if we break down below the lows of the candlestick for Thursday, then I do think we get that 100 PIP move that I talked about previously. We are still technically in an uptrend kind of, but we are at that decision point, and it is always best to let the market do the thinking and simply follow right along.