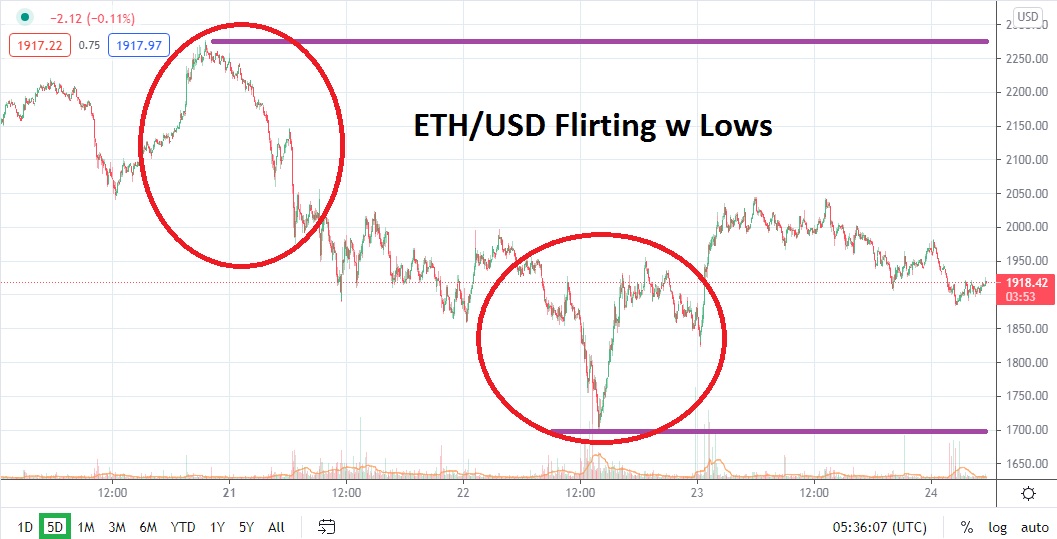

ETH/USD is below the 2000.00 juncture as of this writing. After briefly staging a slight reversal higher a couple of days ago and managing to hold onto some gains, the bullish momentum within ETH/USD proved short-lived, and a retest of support has developed. On Tuesday, ETH/USD tested lows near the 1700.00 mark, which prompted a burst of buying. However, speculators who are buying on new lows are playing a dangerous game and should be engaged in short-lived trading positions.

Tuesday’s drive lower essentially brought ETH/USD into sight of March values; the fact that Ethereum is incrementally lowering its support levels is a troubling worry. Yes, ETH/USD could certainly ignite a rally that surprises the market and crushes anyone with selling positions; this is a cryptocurrency after all, so spikes are part of the trading landscape. However, the mid-term trend for ETH/USD remains within a robust bearish trajectory and, until gains break resistance and sustain higher values, betting against the current cycle of downward pressure may prove to be costly.

As of this writing, ETH/USD is trading near 1925.00 and the support junctures of 1900.00 and 1875.00 should be monitored carefully. The brief rise in prices seen the past couple of days – after new lows were made – was a reminder that no one should expect a one-way direction. Intriguingly, the inability to demonstrate a sustained move above the 2000.00 level appears to be a significant indicator that additional bearish momentum could generate force.

If ETH/USD shows little ability of sustaining a reversal higher towards the 1950.00 to 1975.00 values and remains closer to the 1900.00 juncture, speculative wagers pursuing support levels below may prove worthwhile. Traders should also keep in mind that the past month has seen substantial price action early in the weekends, so it is advised to use vigilant risk management.

Selling ETH/USD continues to look like the more attractive speculative wager in the near term. Ethereum, like the other major cryptocurrencies, remains under a shadow as technical and behavioral sentiment combine and create a rather bearish environment. Traders who are conservative should use limit orders, and perhaps use reversals higher which challenge perceived resistance levels as a location to activate short positions. If ETH/USD continues to move lower, it could spark rather volatile conditions if March support levels are tested further.

Ethereum Short-Term Outlook:

Current Resistance: 1980.00

Current Support: 1885.00

High Target: 2035.00

Low Target: 1770.00