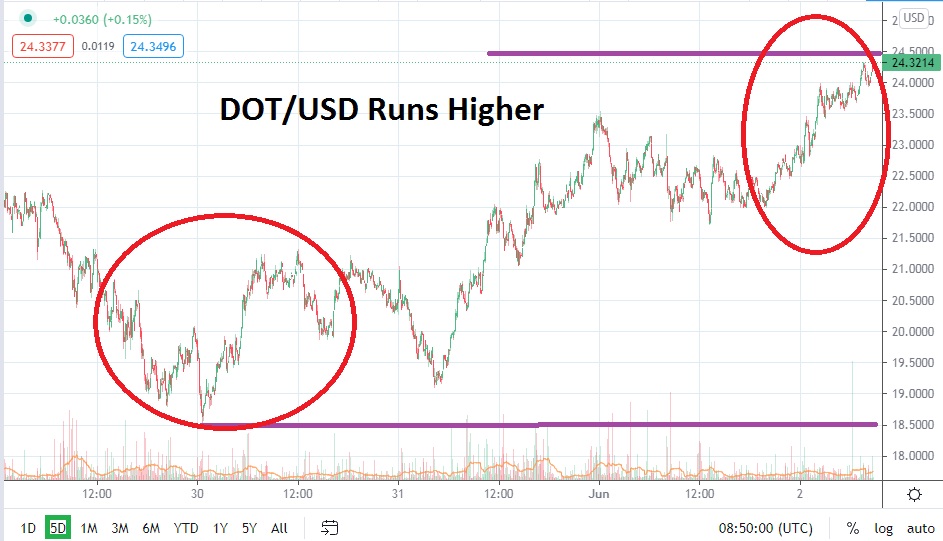

On the 29th and 31st of May, DOT/USD tested lows near the 18.5000 vicinities, but in the past day, the cryptocurrency has demonstrated the ability to run higher. Polkadot is trading close to the 24.4000 level as of this writing, and this value puts it within sight of important resistance that DOT/USD has had a hard time puncturing higher the past week of trading - near the 24.6000 ratio. Because this resistance level is close, traders may instinctively be looking at higher targets. DOT/USD last traded above the 27.0000 juncture on the 21st of May.

Having sounded a positive notion about the short-term bullish move higher achieved the past day, speculators are certainly paying attention. Perceptions and the next moves within DOT/USD may prove important. However, deciding on the short-term potential direction of DOT/USD remains troubling. Even though the cryptocurrency has performed nicely the past day, lows touched only a few days ago should serve as potential warning signs.

The broad cryptocurrency market has shown signs of stability the past couple of days, but a sincere run up in values has not occurred. The recent trading the past week for DOT/USD can still be called consolidated. Technically, that perception may be worrying and cause skeptical traders to have an increased belief that another leg lower is a possibility.

Bullish traders within DOT/USD may interpret technical charts completely differently and believe the cryptocurrency has plenty of room to traverse upwards. A buying position while aiming for targets near resistance junctures of 25.1700 to 25.5000 may prove to be a logical decision. However, suspicious speculators may believe that until the 24.6000 level is punctured, it is not safe to wager on more bullish momentum. A conservative trader could place a buying order above current prices, near the 24.6000 to 24.7000 levels to activate a long position based on the notion that if these targets are hit that momentum will increase upwards.

However, after reversing higher the past day, there is a notion too that the gains made in DOT/USD could erode if nervous conditions prevail in the cryptocurrency market short term. Selling DOT/USD near its current price levels and aiming for support levels below may prove to be the best speculative wager in the short term.

Polkadot Short-Term Outlook:

Current Resistance: 25.1700

Current Support: 23.1100

High Target: 27.5400

Low Target: 18.5300