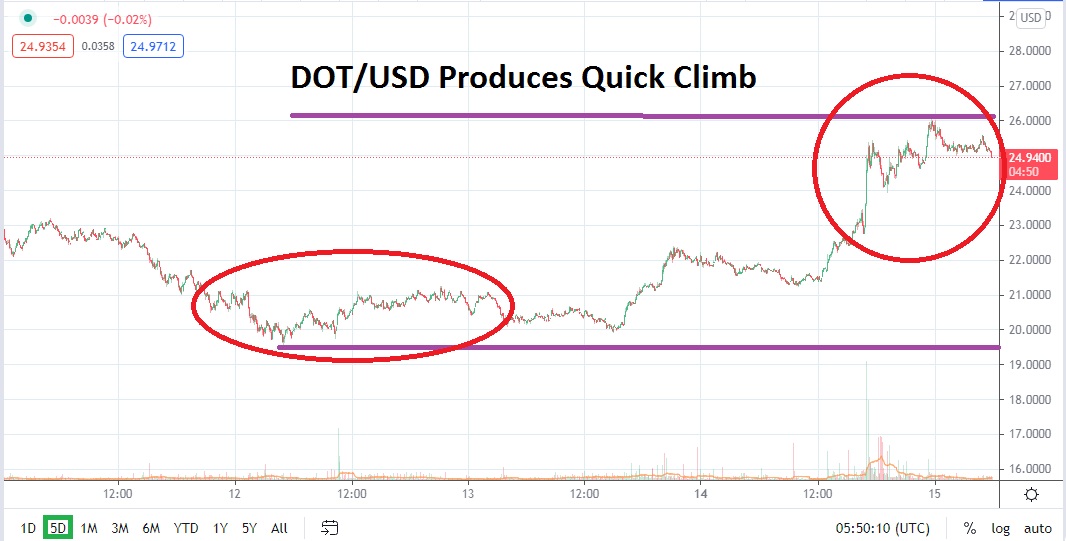

DOT/USD has climbed from support of nearly 19.7500 since the 13th of June and is traversing slightly above the 25.0000 mark as of this writing. The move higher in Polkadot has been sparked by an announcement via Coinbase that has confirmed DOT/USD will be able to be held on the large cryptocurrency exchange. Polkadot is currently ranked as the 8th largest cryptocurrency regarding market capitalization, and its listing on the Coinbase exchange could significantly affect its trading volumes.

While DOT/USD is trading slightly above the 25.0000 ratio as of this morning, traders will want to acknowledge that Polkadot was trading above 28.0000 on the 3rd of June. This is pointed out to show that the positive price action within DOT/USD has been significant, but it is still trading below its highest values produced in June. Technically, traders may be tempted to be buyers of DOT/USD because of the ‘push’ from influencers who are exclaiming the virtues of Polkadot, but before wagering speculators may want to ask if the sudden spike higher will run out of steam near term.

DOT/USD is likely to remain volatile short term. Traders will be confronted by potential speculative waves generated because of the rather high-pitched backing Polkadot is receiving in some social media circles. Technical traders are advised to look at their charts and consider the possibility that the whirlwind which has produced significant gains may also run into price resistance.

Because of the leap in value displayed in DOT/USD, traders definitely need to use limit orders to protect against unflattering fills. The current value level of DOT/USD is near the 25.0000 vicinity, and this can be judged as an important psychological juncture. The last time DOT/USD traded near this level was on the 7th of June. If DOT/USD is truly aiming for higher resistance, there is little doubt that some speculators may be targeting the 26.0000 level as a place to cash out take-profit positions. No matter what a trader decides to do in the short term, the use of stop-loss and take-profit orders should be practiced.

DOT/USD is certain to produce fast results in the coming hours as traders continue to react to the listing on Coinbase. Bullish speculators cannot be blamed for wanting to make a wager on more upside developing, but they are encouraged to have realistic goals and protect themselves against the potential for spikes which could prove dangerous. Buying DOT/USD near the 25.0000 to 24.5000 junctures and looking for higher values short term is speculative, but may prove to be a solid speculative bet.

Polkadot Short-Term Outlook:

Current Resistance: 26.2000

Current Support: 24.5000

High Target: 28.5000

Low Target: 21.2300