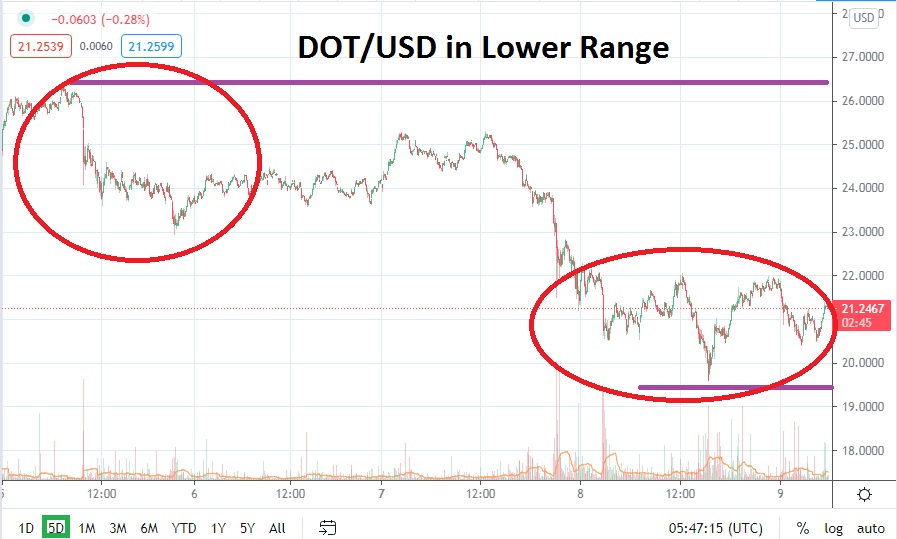

DOT/USD has been taken lower again the past day of trading and is hovering over important support levels which, if proven vulnerable, could set off additional selling for Polkadot. DOT/USD is trading near the 21.3000 mark early today and has tested the 20.0000 juncture below too in the past day. Polkadot is swimming in dangerous waters and if the 20.0000 is broken lower and sustained, speculators who have decided to wager on bullish sentiment re-emerging may find the tide is too strong and drown.

While cryptocurrency speculators have proven to be an optimistic crowd the past six months, the last four weeks have been extremely difficult if buying positions have been targeted. After attaining a high on the 15th of May around the 49.5000 mark, DOT/USD has been hit by a stark selloff. Curiously, Polkadot is now hovering near support levels which are from the second week of February. Technically, if DOT/USD punctures the 21.0000 and 20.0000 junctures, and the broad cryptocurrency market sentiment remains fragile, speculators will have plenty of reasons to suspect that lower targets may come into play.

From a risk/reward standpoint, when considering technical charts, traders may come away with the perception that short-term indicators suggest there is more room to explore downward compared to the potential of advancing higher. Certainly DOT/USD could stage a sudden comeback and demonstrate a higher move which crushes current resistance levels. However, speculators should ask themselves if they really want to challenge the prevailing trend.

Traders who are sellers of DOT/USD should not be too greedy with their goals. In other words, while negative sentiment may be pervading the broad cryptocurrency market, traders should not create unrealistic targets. It is better to cash in winning trades before ‘virtual’ profits vanish because of a sudden reversal higher which then triggers the temptation to keep a trade open longer than anticipated. Using adequate take-profit orders and having them securely entered into the trading platform so they can ring the register is a solid tactic.

DOT/USD continues to trade near support and, if the nearby junctures of 21.0000 to 20.0000 fail to hold, selling could increase. Cautious traders may want to enter selling positions on slight reversals higher, but if they choose to be aggressive this cannot be faulted. Using nearby resistance levels as stop-loss ratios could be effective short term.

Polkadot Short-Term Outlook:

Current Resistance: 22.6300

Current Support: 20.5000

High Target: 23.3300

Low Target: 16.3500