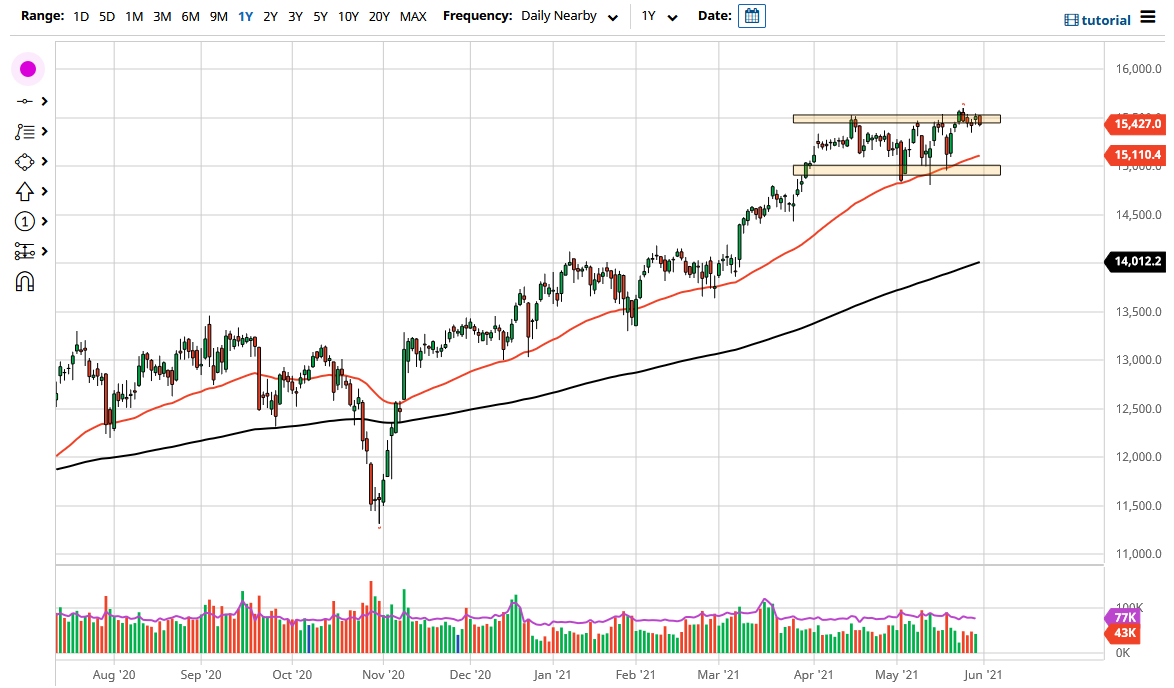

The DAX Index pulled back a bit during the trading session on Monday as the 15,500 level continues to show significant selling pressure. If we pull back from here, it is very likely that we could find buyers underneath, as we have been in a significant uptrend for the longer term, but recently have been killing off time as the market may have gotten a bit ahead of itself.

Looking at the 50-day EMA, it has broken above the 15,000 level and is rising at a decent pace. Because of this, I do believe that there is a significant amount of support underneath that the markets will continue to pay attention to. Furthermore, the 15,000 level underneath is essentially the “floor in the market”, as we have seen over the last several months. Nonetheless, the DAX continues to be a focal point of money flowing into the European Union, as we start looking at the reopening trade.

Keep in mind that Germany is the first place that money goes flowing to due to the fact that it is such a major exporting economy and is the economic engine of the EU. The European Union is currently starting to see the reopening trade come back into play and, as a result, the DAX is going to reflect the fact that a lot of people are expecting exports in Germany to continue flowing around the conduit and beyond. After all, a lot of the German economy is based upon exporting major industrials, so I think this is a play not only on the EU but also the rest of the world.

If we can break above the 15,600 level, then it opens up a move to the 16,000 level, based upon the “measured move” of the rectangle that we are breaking out of. Because of this, I like the idea of buying dips and holding for the breakout because of the overall attitude of stock indices around the world, and the fact that the central banks around the world continue to add liquidity. In other words, traders are simply buying anything they can to get away from inflation effects, so stock indices will continue to rise across the world by default anyway.