Last Monday’s Bitcoin signals may have produced a losing long trade from the bullish bounce at the support level identified at $32,343.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be taken before 5pm Tokyo time Thursday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $32,154 or $28,607.

- Put the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $36,279 or $37,198.

- Put the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

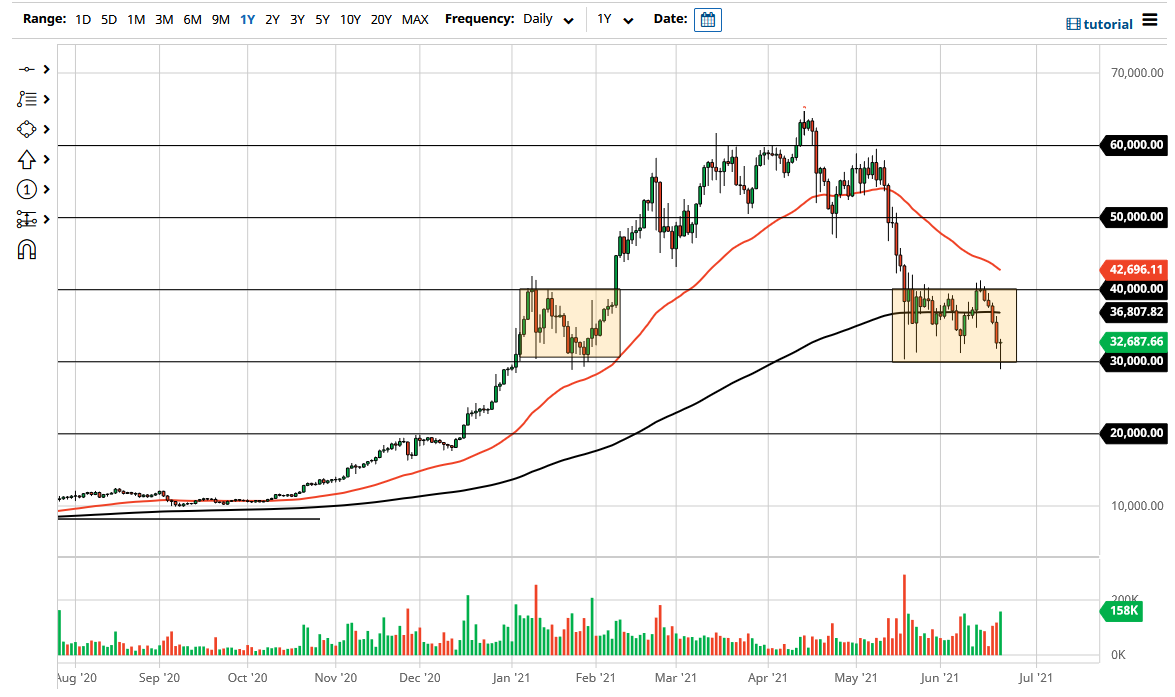

I wrote last Monday that we were seeing a much more bearish technical picture as partly evidenced by the recent “death cross” on the daily chart, with the 50-day SMA crossing below the 200-day SMA.

I thought that the price was likely to move lower on Monday, and if either of the nearby support levels were reached and showed a strong bounce that could be a brave long or medium-term long trade opportunity, but if the price got established below the support level at $28,607, that would be very bearish and would be likely to trigger a fast, sharp fall to $20k or even $10k.

This was a good call, as the price did move lower over Monday, and then yesterday made a strong bullish reversal right at $28,607 which has turned out to be a very pivotal level just as I expected.

I had thought there was a good chance we would see a strong bearish breakdown with Bitcoin quickly reaching $20k or even $10k, but that danger to Bitcoin bulls seems well averted now after yesterday’s very strong bounce.

Much is now likely to depend upon whether the new support level at $32,154 holds. A bullish bounce there could be a good medium to long-term long trade entry, and I will be happy to take it if it sets up.

Concerning the USD, there will be a release of Flash Manufacturing & Services PMI at 2:45pm London time.