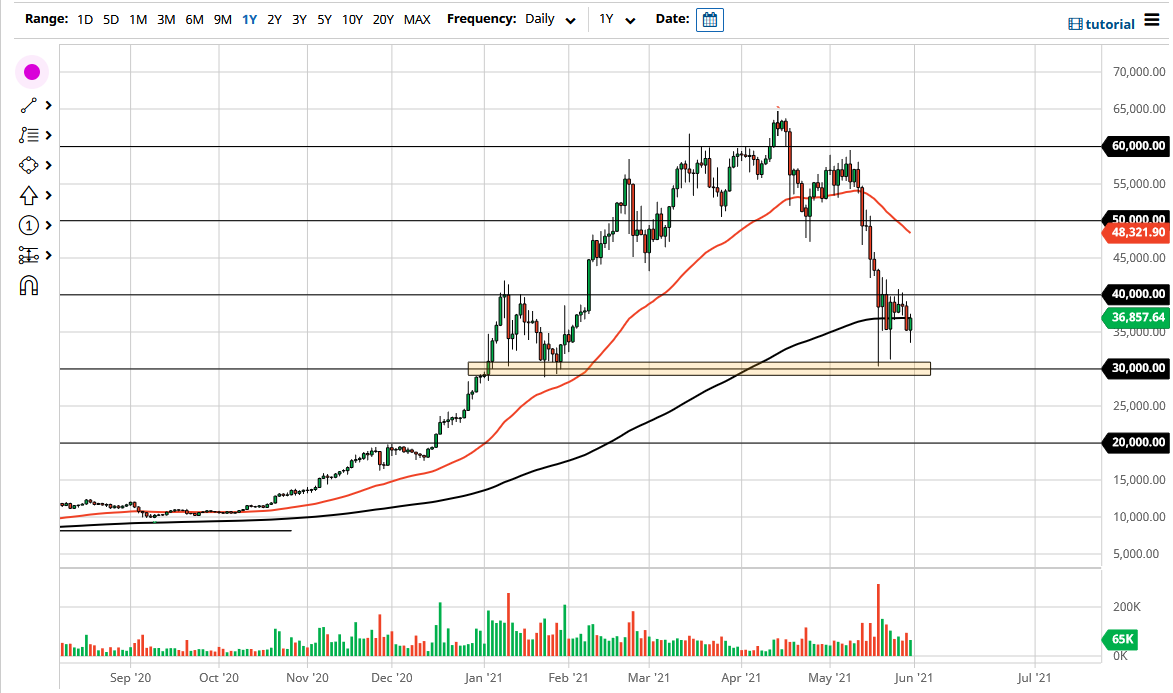

Bitcoin fell a bit during Monday's trading session only to turn around and show signs of life again. That being said, it should be kept in the back of your mind that it was Memorial Day, so one would have to think that there is a liquidity issue when it comes to certain parts of the day. I think what we are looking at here is a situation where the market is tentatively looking at the $35,000 level as support. Beyond that, we also have the $30,000 level as potential support, as we have bounced from there couple of times.

It is worth noting that we are sitting just below the 200-day EMA, so I think a certain amount of hesitation may be part of what is going on here. For myself, I believe that if we can break above the $40,000 level, it is likely that the Bitcoin market will continue to go higher. That would clear enough resistance that I think a lot of people would be paying close attention to the market and getting long again. That for me would open up the possibility of testing the $60,000 level.

However, I also recognize that we could be looking at a situation where we continue to go sideways for the short term, trying to find enough stability to go higher. If we break down below the $30,000 level, that would be extraordinarily negative for this market and could open up a move down to the $20,000 level. Because of this, I think you need to be very cautious about your position sizing, as we are most certainly at a fork in the road. The real question at this point is whether or not we can continue the longer-term uptrend, or if we are about to see another crash.

As a general rule, the longer we go sideways after a move like this, the better off we are going to be for a longer-term trend. After all, if we can stay in this general vicinity for a while, people will start to trust the market again. The psychological damage that the recent sell-off has done cannot be overstated, so it certainly should be kept in the back of your mind when analyzing. This is why I believe that if we do break down below the $30,000 level, the move to the $20,000 could be rather quick.