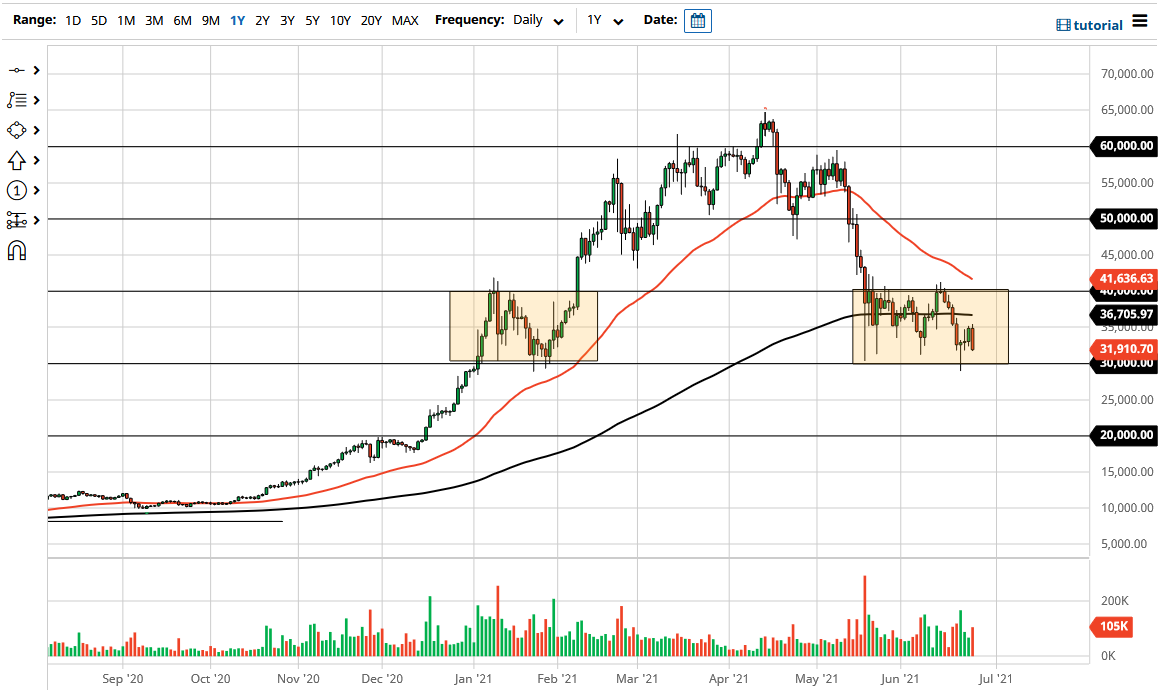

Bitcoin fell during the trading session on Friday as the 35,000 level has offered enough resistance to turn the markets back around. At this point, the market is likely to continue to respect the $30,000 level underneath as major support. Breaking down below the $30,000 level could open up the possibility of a move down to the $20,000 level, and I think it could happen rather quickly.

Bitcoin looks absolutely horrible at this point with the market most certainly threatening that $30,000 level underneath as the most recent high was less impressive than the one before it. Furthermore, the 200-day EMA continues to offer significant resistance, so it is very likely that sellers will be waiting just above. At this point, the 200-day EMA is somewhat flat, so we could stay in this consolidation; but the longer that we do, the more likely it is that we will eventually see some type of event to kick this market over again.

In fact, I would not be a buyer of Bitcoin until it clears the consolidation area, meaning that we need to see a daily close well above the $40,000 level. The 50-day EMA sits at the $41,636 level, so you can use that as a benchmark as well. If that does happen, then it is likely that we would see this market looking towards the $50,000 level over the next several weeks. That being said, the momentum is certainly falling, and we are getting dangerously close to the so-called “death cross”, when the 50-day EMA drops below the 200-day EMA, which is a longer-term bearish signal.

It has been an interesting last 18 months or so, because it reminds me a lot of the last time the Bitcoin bubble blew up. Hindsight is always 20/20, but at the end of the day this looks very much like what we saw after that run out, as everybody was talking about Bitcoin, the scammers came out of the woodwork, and every other comment on YouTube was about all of the money that could be made on Bitcoin. In the end, things are not different this time, because they never are.

If Bitcoin does break down, I think at the very least you are looking at a move down to the $20,000 level. This is not to say that Bitcoin cannot recover, it is just that things are looking very poor. I do believe that the best thing that could happen to the market is a couple of years’ worth of “crypto winter”, as it could offer a nice opportunity to start building up for the next surge higher.