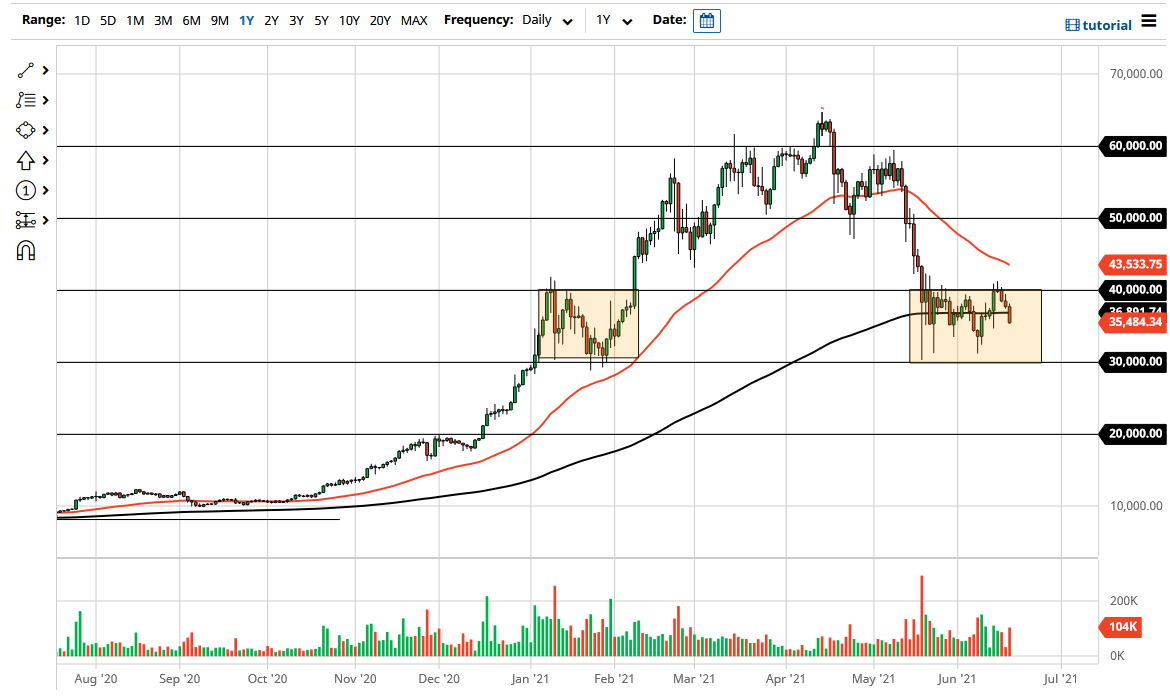

The Bitcoin market broke down during the trading session on Friday again, as the market dropped below the 200-day EMA. Now that we have done this, it looks like we are simply going to continue the overall choppy behavior, trading between the $40,000 level on the top, and the $30,000 level on the bottom.

With that being said, the market is essentially stuck in a range as we try to figure out whether or not crypto will get sent lower in general, or if we get a little bit of accumulation in order to send the market higher again. In the short term, the simple technical analysis suggests that we have nowhere to be, and you should simply wait for a break higher or lower out of the $10,000 box. To the upside, if we were to break above the $40,000 level, then it is likely that we will go looking towards the $50,000 level where I see a significant amount of potential resistance based upon psychology and previous market structure in the form of support. To the downside, the next major support level that I see is the $20,000 level, based on psychology and previous action as well.

I suspect that the US dollar also has its part to play in the situation, as it has been strengthening for the last several sessions. That has also sent the market lower, as the Bitcoin market is priced in US dollars. Nonetheless, when you look at the overall attitude of this market, I do not know whether or not the US dollar is the main problem. After all, the Bitcoin market is struggling due to the perceived bubble, which makes sense considering that the market went straight up in the air just a handful of months ago.

If the market were to drop down to the $20,000 level, it would be a complete “round-trip” since the major breakout and I think a lot of buyers would be down in that area. That is essentially what I am hoping for in order to find enough value to get involved in this market. Whether or not I get that might be a completely different question, but right now that is what I am hoping for.