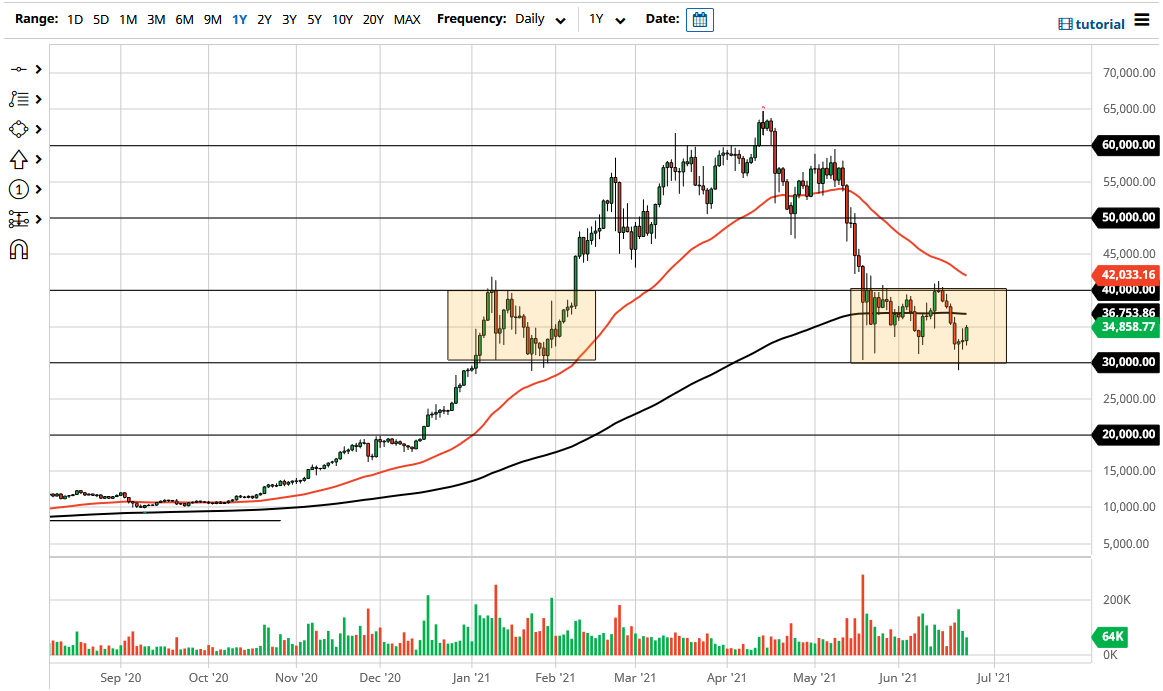

The Bitcoin market has rallied a bit during the course of the trading session on Thursday, reaching towards the $35,000 level. What is even more important is that we are closing towards the top of the shooting star from the previous session, so if we can continue to go higher, it is likely that the market could go looking towards the 200 day EMA next, which sits at the $36,750 region.

After that, it is likely that the market will go looking to press against the $40,000 barrier, which I think extends for about $1000 or so. Breaking above that would finally allow the Bitcoin market to go looking towards the $50,000 level, which of course is an area that had previously been supportive and resistive. It is a large, round, psychologically significant figure, so in and of itself we will see quite a bit of headlines if we get there.

To the downside, if we were to break down below the hammer on the Tuesday session it is likely that Bitcoin will fall apart and go looking towards the $20,000 level underneath, which is the next major round figure in of course an area where we have seen a lot of support and resistance previously. In other words, it could act a little bit like a “trapdoor opening”, meaning that the market will drop rather quickly. While I believe that this scenario is still very much possible, the last couple of days have brought down the risk of that by a bit.

Keep in mind that Bitcoin is also paired against the US dollar in this pair, and therefore you need to pay close attention to what is going on with the greenback. If the US dollar suddenly starts to strengthen, you might see money flowing out of Bitcoin and crypto in general. Remember, the Bitcoin evangelists desperately wanted institutional money to come into the market to support it, but I think they were not thinking about how institutional money will also come in and dump this market at the first hint of causing issues. In other words, Bitcoin is going to trade quite differently than it did just a couple of years ago and could very well end up trading much like an index than anything else. If that is going to be the case, that of course it goes higher, because it will be supported.