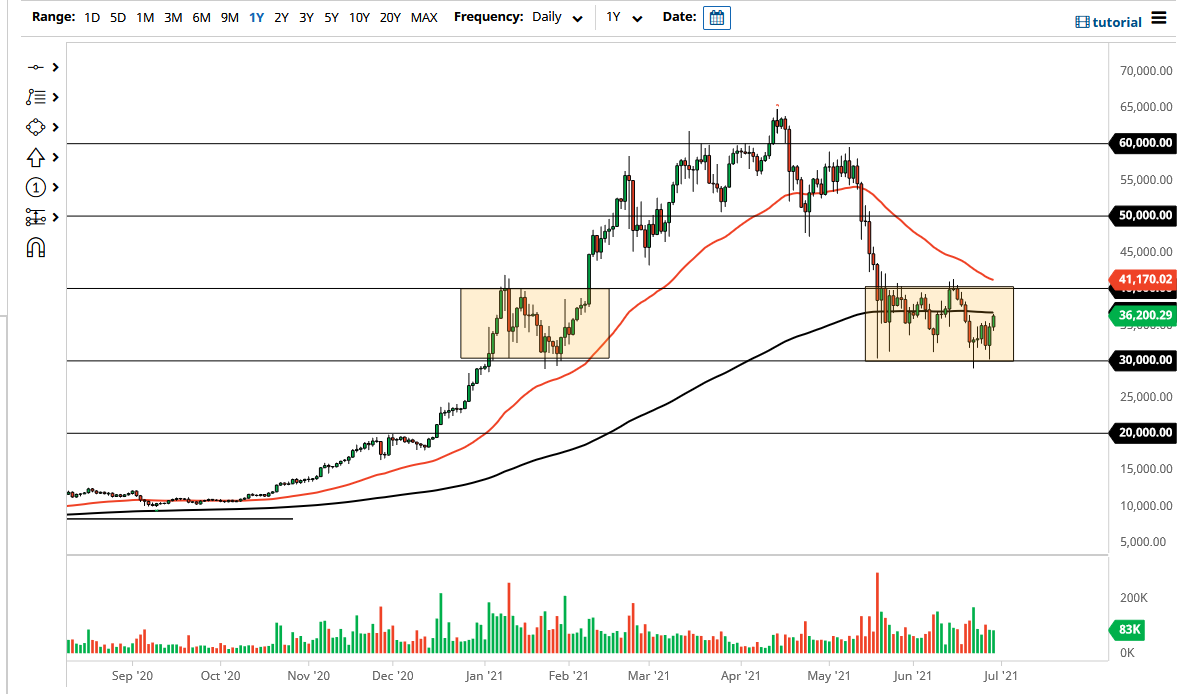

Ultimately, the market has been consolidating between the $30,000 level on the bottom, and the $40,000 level on the top. Furthermore, the 200 day EMA cutting just above the closing price during the day suggests that the resistance will be found, at least short term. However, the fact that it is flat also suggests that perhaps we are simply trying to continue the consolidation that we have been in.

At this point, if we were to break above the 50 day EMA, which is currently at the 41,000 level, it is likely that the market could go looking towards the $50,000 level next. That would be very strong and could be an area where we would see a certain amount of resistance based upon psychology. However, we could just as easily turn around and reach towards the $30,000 level underneath, which has held relatively true as massive support. If that were to give way to bearish pressure, it is likely that the Bitcoin market could go looking towards the $20,000 level rather quickly. Yes, this is a market that is still very much in a consolidation pattern and has to be looked at through that prism.

It is not until we break out of that $10,000 range that I think you can put any serious money to work unless of course you are looking to range trade this entire area. If that is the case, then it obviously a completely different scenario but for most traders they will be looking for the bigger move, and therefore they may have a bit of waiting ahead of them over the course of the next several weeks. Keep in mind that Bitcoin has retraced half of its value and just the last few months, so at the very least it would not be a surprise to see this market need to catch its breath.

Furthermore, you should probably pay somewhat close attention to the US dollar, because if it starts to strengthen that may lead people to dump Bitcoin as it could be thought of more as along the lines as a “risk off” type of scenario, which of course works against Bitcoin now that so much institutional money is starting to get involved.