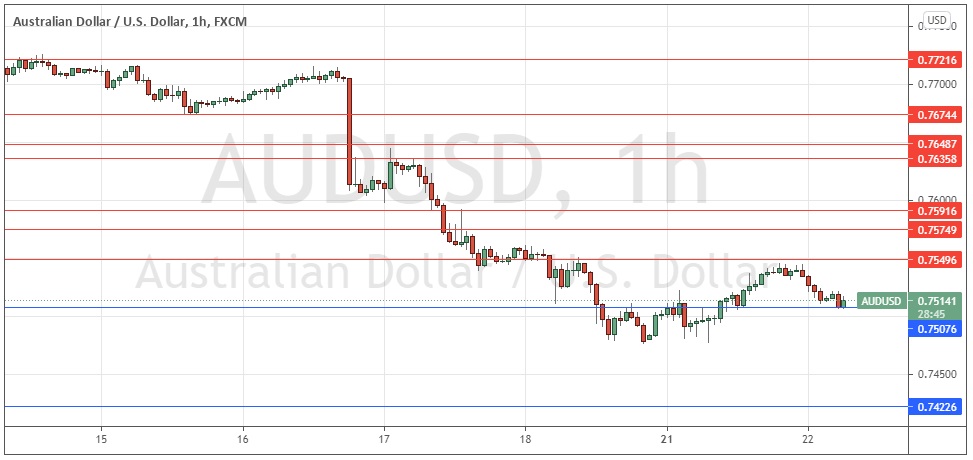

My last AUD/USD signals on 10th June produced an excellent and extremely profitable short trade from the bearish reversal which happened at the resistance level I had identified at 0.7776.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken before 5pm Tokyo time Friday.

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7550, 0.7575, or 0.7592.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7508 or 0.7423.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote on the 10th of June that we were likely to begin to see a strong directional price movement after such a long period of consolidation, and we did, so this was a good call.

The last few days have seen a strong decline in risk currencies such as the AUD and an equally strong advance by the USD and JPY. This has sent this pair sharply lower, ending last week at a 6-month low closing price, which is a bearish sign.

Such strong bearish momentum as we are seeing is likely to have some follow through, so I expect the price to move down at least a little. However, we have seen a weak recovery from the 0.7500 area over the past day, which included the printing of a fresh higher support level at 0.7508. Provided that the price holds up above these levels, there is some short-term hope for bulls.

The nearest resistance level at 0.7550 looks likely to be strong and due to the long-term bearish trend, I will be very happy to enter a short trade there today if the price retraces back to that level and then makes a firm bearish price action reversal.

The chairman of the Federal Reserve will be testifying before the U.S. Congress at 7pm London time. There is nothing of high importance due today regarding the AUD.