The Australian dollar got hammered during the trading session on Thursday as traders ran into the US dollar due to the better than anticipated Initial Jobless Claims, having traders freak out and go running towards the idea of the Federal Reserve tapering quicker than anticipated. The reality of course is that they will not, and I do not have any idea as to why so many market participants think that they will suddenly change their course of action that they have been on for the last 13 years. Yes, it is possible that inflation comes down the road, but quite frankly it is difficult to imagine a scenario where the Fed suddenly tightens, and therefore strengthens the US dollar.

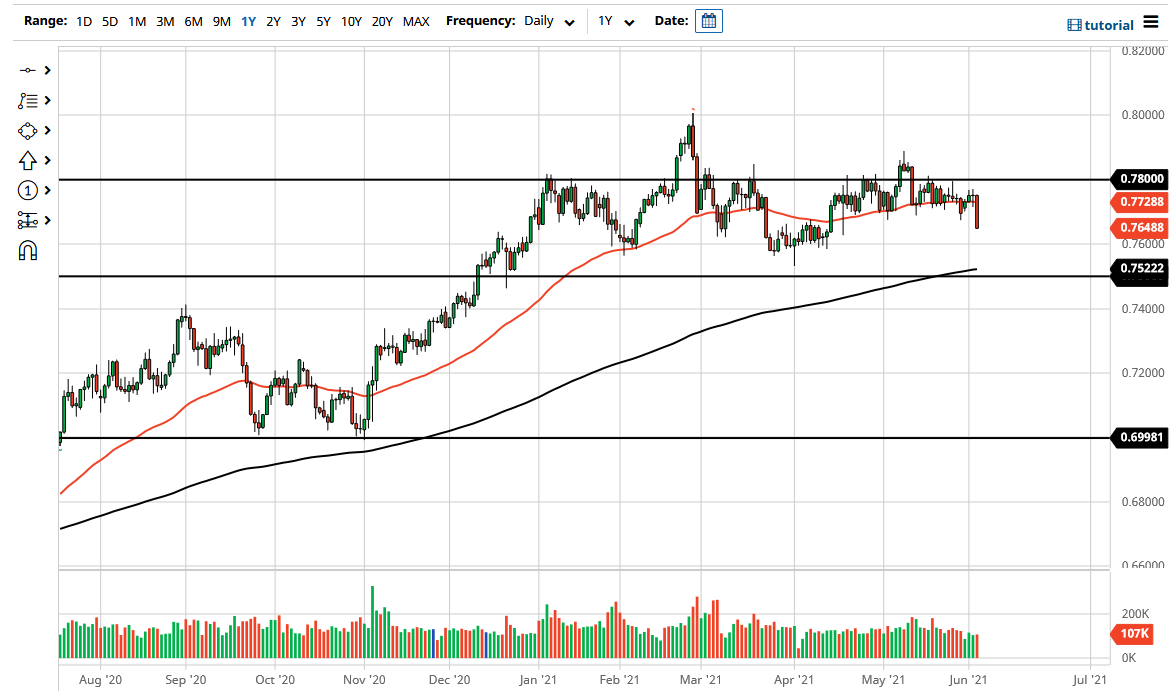

At this point in time, the Australian dollar has been hit especially hard as the commodity market has suffered by the strengthening greenback, so it more or less is a feedback loop. At this point, it appears that the market is probably going to go looking towards the 0.76 handle, maybe even the 200 day EMA underneath. The Australian dollar has put traders to sleep for several weeks now, and unfortunately tomorrow is the jobs figure, so it is not necessarily a good idea to jump right into it at this point. In other words, you are essentially held hostage by whatever liquidity games are going to be played at 830 in the morning New York time.

With all that being said, there is a possibility that we get a move, but it is not until we break down below the 0.75 level that I particularly interested in shorting the Aussie dollar. If that does happen, it is very likely that you will be buying the US dollar against almost everything at the same time, so it should be rather obvious. For myself, the most likely trade is going to be some type of bounce in the neighborhood of 0.76 and an attempt to get back to the same area we have been grinding back and forth and for what seems like a lifetime. The Aussie dollar will continue to grind away, mainly because people have no idea what to think about inflation, which unfortunately is going to be the headache of the year. Expect choppy and volatile trading, but I still do not like trading this market as things stand.