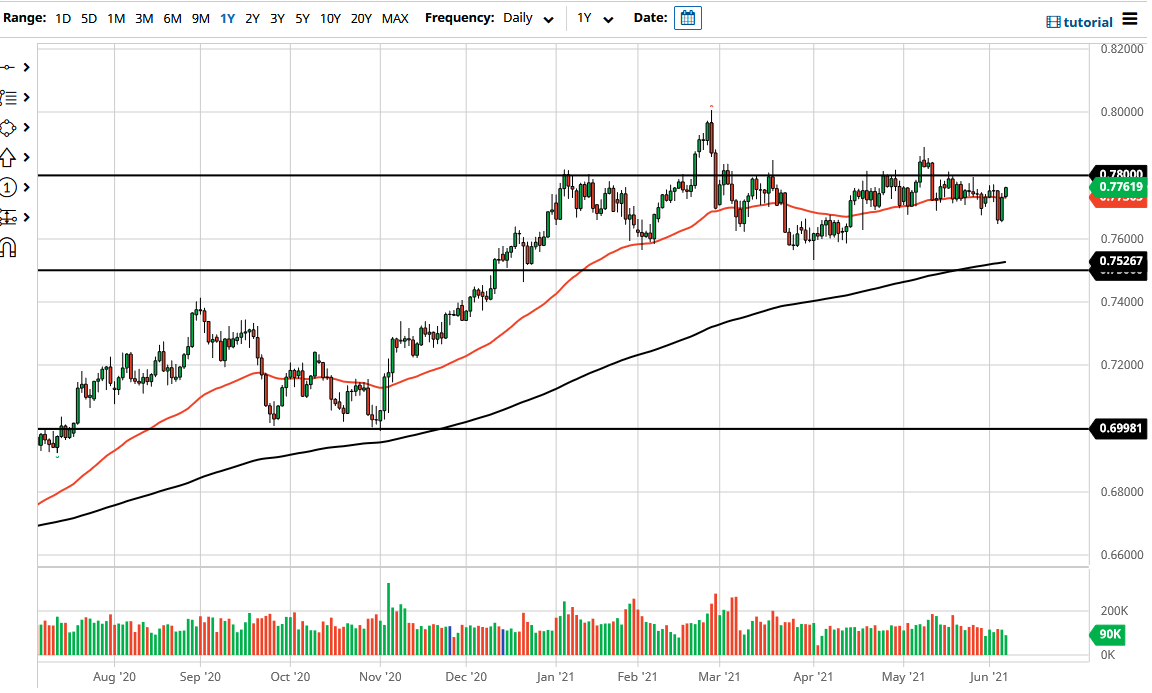

The Australian dollar rallied on Monday to show signs of continuation of the sideways action. The 50-day EMA sits just at the bottom of the candlestick for the Monday session, but the most important thing to pay attention to is the fact that the 50-day EMA is going flat, and that essentially tells you that the market has nowhere to be, at least in the time being.

When you look at the chart, you can see that the 0.78 level offers plenty of resistance, as we have pulled back from there more than once. To the downside, the 0.76 level seems to be massive support, and I think that is your overall range that we need to pay close attention to. The Australian dollar continues to struggle despite the fact that there is a significant amount of demand for commodities, which typically will push this market to the upside. That being said, there might be a certain amount of influence being felt from the Australia/China spat over trade that has been going on. After all, the Chinese have stepped away from Australian coal and some of their other hard assets, which has its influence on the Aussie economy.

The candlestick for the trading session suggests that the buyers are still very strong, but we are getting close to resistance that is worth paying attention to. The market breaking above the recent high during the month of May might open up the possibility of a move towards the 0.80 level. That is an area that being broken to the upside could kick off a huge move.

To the downside, if we were to break down below the 0.76 level, I think there is plenty of noise that goes down to the 0.75 handle. Breaking down below there would then open up a bit of a “trapdoor” to go much lower, perhaps down to the 0.70 level. That being said, as things stand right now, I still believe that you are much likelier to see profit if you are buying dips and trying to sell breakdowns. After all, we are essentially going sideways after a huge move higher, which is quite typical of markets trying to work off the built-up froth of the perhaps overextended move for previous monthly candlesticks.