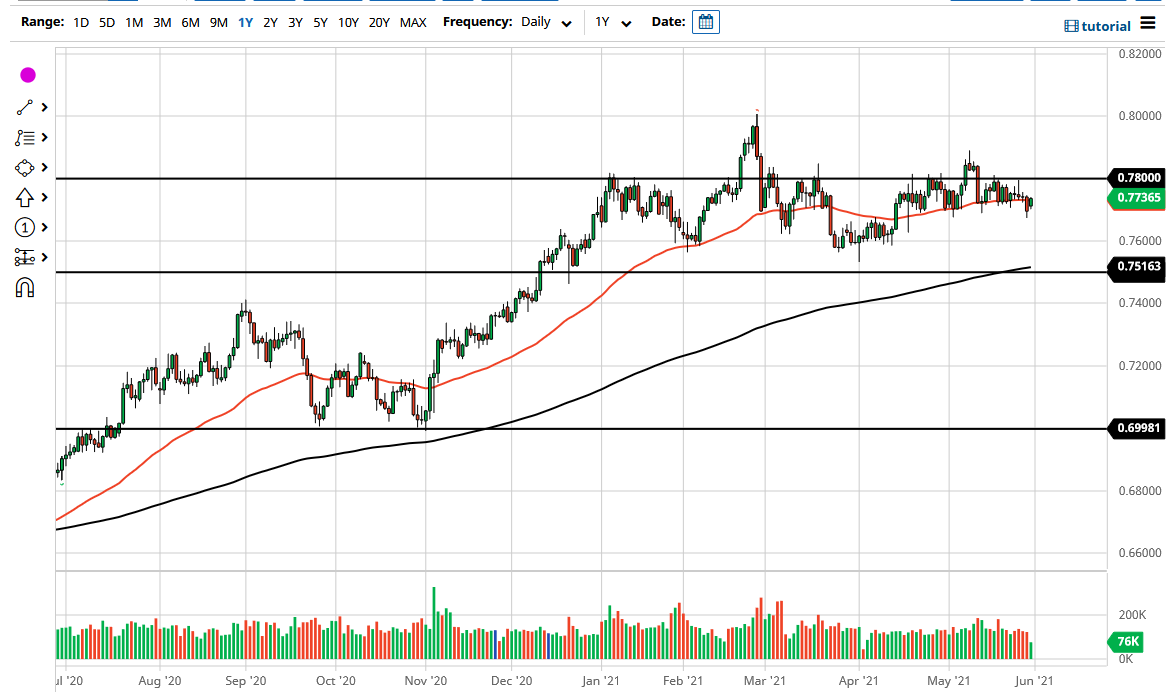

The Australian dollar rallied a bit during the trading session on Monday to reach just above the 50-day EMA. The 50-day EMA is an area that a lot of technical traders will pay close attention to, and because of this, the pair itself has attracted a lot of attention. As you can see, the last couple of weeks has seen the 50-day EMA offer significant support, so it is not a huge surprise to see the market turn around.

That being said, it is probably more important that the 0.77 level has held, as it is a large, round, psychologically significant figure, and an area where we have seen support and resistance previously. Above there, the 0.78 level has been resistance, and currently is the top of the overall range. Breaking above there would be a good sign, but you can see how we had done that just a couple of weeks ago, so it is worth noting that we could do it again without truly changing too much.

Because of this, we have a market that is trading in a very sloppy consolidation range. I think that might continue to be the case as the fundamental picture between the Australian dollar is a bit mixed at the moment. Yes, we have the reopening trade going forward, but commodities are starting to stagnate a bit, as perhaps they have run a little too far to the upside. Furthermore, China and Australia are in a bit of a trade spat, so that is something to pay attention to as well.

If we did turn around and break down below the 200-day EMA, which is extensively the 0.75 handle, then I would anticipate that this market would break down rather significantly. It is not necessarily my best-case scenario right now, but I do know that it is a possibility. To the upside, if we can clear the 0.80 region, it is very likely that this market could take off for a longer-term “buy-and-hold move.” At that juncture, I would anticipate that the Aussie dollar could go as high as the 0.90 level above, which is the next major area on the monthly charts. That does not necessarily mean that it will be easy, but if you are a longer-term investor, that might be what you are looking to see happen.