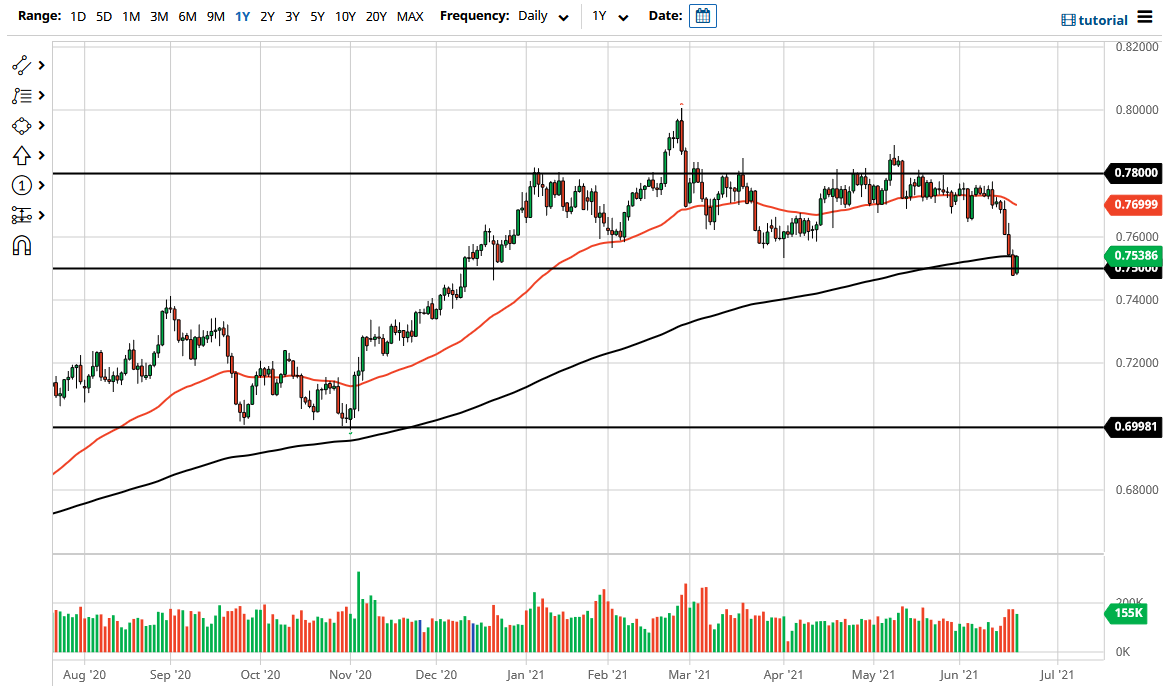

The Australian dollar rallied a bit during the trading session on Monday to reach towards the 200-day EMA. That being said, the market has also respected the 0.75 handle, which is a major area of interest to traders around the world. The question now is whether or not this level can hold, or whether or not we will turn around and breakdown through it.

If we were to break down below the lows of the last couple of days, then the market is likely to go much lower, perhaps reaching towards the 0.71 handle. The market did exactly what it needed to do in order to save itself, so now the question is whether or not we can continue the upward momentum. That is the question of the day for the Australian dollar on Tuesday, and at this point I believe that if we take out the 0.76 handle, then we could see a full recovery.

However, if we were to break down below the lows of last couple of days, I anticipate that there should be a significant amount of momentum, perhaps making this market crash due to the idea of a major “risk-off move” overall, not just in this market. If the Federal Reserve starts talking about tightening again, that could spook the market, but I believe that Jerome Powell will probably say as little as possible to upset the market after the last couple of days while he testifies on Tuesday.

In general, this is a market that I think is probably best left alone in the short term. If I were to short the US dollar, I would do it in the USD/CAD pair, because although it looks like the US dollar is falling, the reality is that it could turn around again and the Canadian dollar is also highly correlated to crude oil, which is shooting straight up in the air. In other words, although the US dollar could fall, it probably has more momentum against the Canadian dollar than the Aussie dollar. With that, the Canadian dollar or even the Norwegian krone are my favorite commodity currencies at the moment, with the Australian dollar probably a bit of a laggard against those.