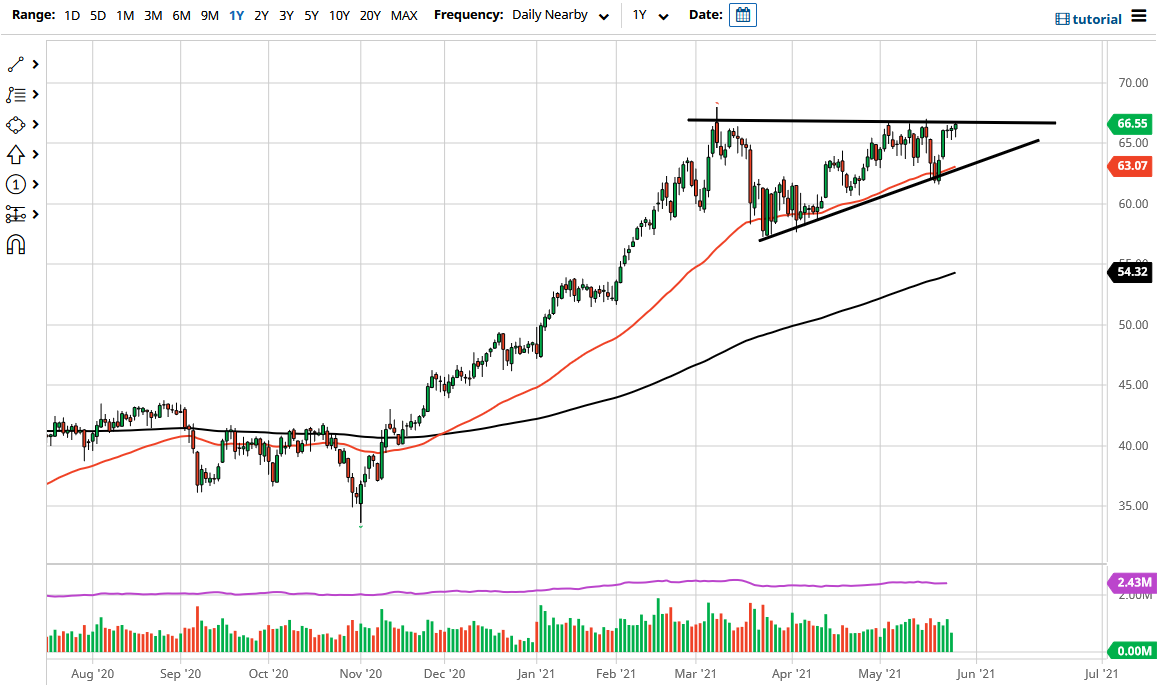

The West Texas Intermediate Crude Oil market has pulled back a bit to kick off the trading session on Thursday before shooting straight up in the air to try to break out above the resistance barrier that we formed over the last month or so, and previous action suggested that was going to happen. The market looks as if it is trying to break out and if we can clear the $67.50 level, that would kick off more buying. At that point, the market will more than likely go looking towards the $70 level, but it might be just the stop on the way to the $72.50 level. Ultimately, a daily close above that level is what I need to see in order to start buying in aiming for those targets.

Pullbacks from here should continue to attract a lot of attention, especially near the $65 level where we had seen support previously. Underneath there, then we have the 50 day EMA coming into the picture that offers support right along with the uptrend line. Because of this, I think it is only a matter of time before buyers would come in to pick up value. After all, there is a lot of talk about the reopening trade over the next few months and therefore demand for crude oil should be picking up in theory. The crude oil markets are a great indication of economic growth or weakness.

All things been equal, I do not expect to see a significant break down and it appears that the move below the 50 day EMA could open up a move down to the $60 level, which is an area where we have seen a lot of support previously. Breaking down below that level opens up the possibility of a move down to the 200 day EMA which is currently reaching towards the $55 level. Although this is possible, this is not something that I expect to see anytime soon. If we were to break down below there, then it would send crude oil markets much lower, perhaps entering some type of massive selloff like we had seen previously.

All of that being said, the fact that we are closing at the top of the candlestick for the trading session does suggest that we are ready to go higher and perhaps really start to take off as volatility has been compressed for some time.