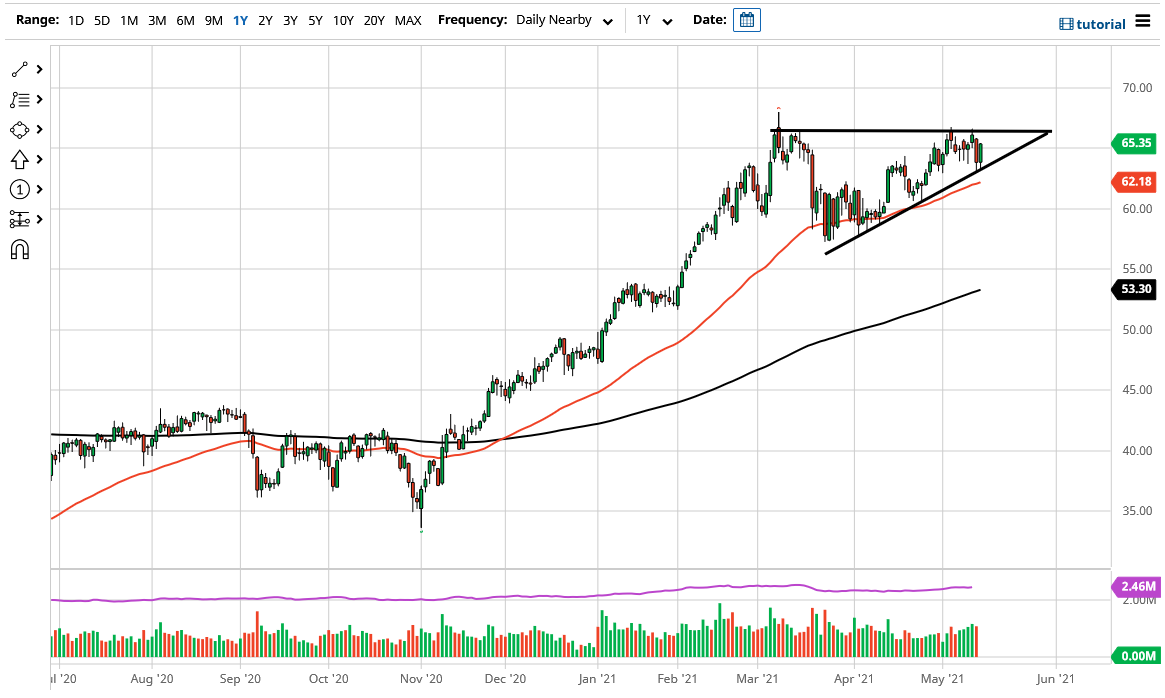

The West Texas Intermediate Crude Oil market has initially tried to pull back a bit during the trading session on Friday, to test the uptrend line from the ascending triangle that we have been stuck in. The 50 day EMA sits underneath there as well, so I think there are plenty of reasons to believe that the market is going to find plenty of buyers. That being said, we turned around completely to break above the $65 level, and it looks like we are going to attempt to go towards the $66.50 level.

If we were to break above the top of the triangle, then it is possible that we could see the market break significantly higher, perhaps to reach towards the $70 level rather quickly, and then possibly even as high as $76.50 based upon the “measured move.” The crude oil market continues to show signs of strength in general, so I do not have any interest in trying to go against it. Furthermore, you should also keep in mind that a lot of people will be playing this market from the reopening trade aspect, and therefore I think the fact that we closed at the top of the range for the day suggests that there is plenty of confidence going forward.

If we were to break down below the 50 day EMA, then the market could go looking towards the $60 level rather quickly, which of course is a large, round, psychologically significant figure. That area has been an area of support previously, so all things being equal it is likely that we will see volatility to say the least, but it is obvious to me that the buyers come in and try to pick up value every time it shows up. The volatility continues to be very noisy, but when you look at the chart it is hard to deny the fact that it goes from the lower left to the upper right over the last several months, and it is likely that we are going to continue to see buyers based upon a time there is value and of course the idea that the US dollar falling should continue to pick this market up as well. I think the next couple of days will be very noisy, but it certainly looks as if we are building up the pressure necessary to break out.