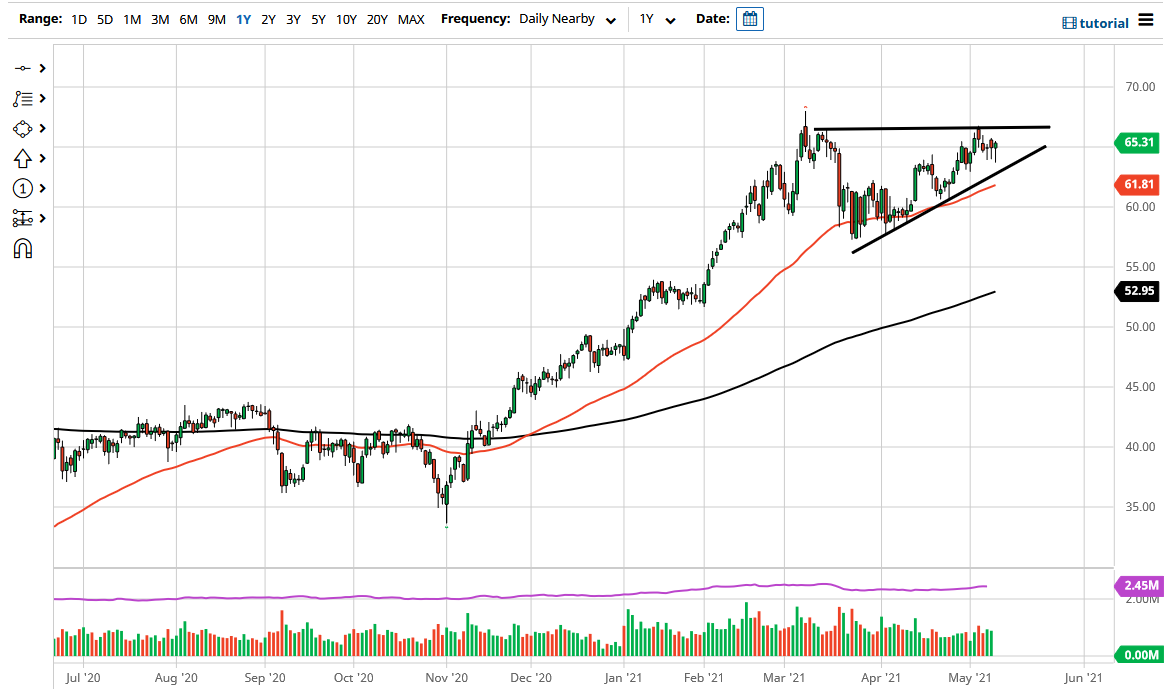

The West Texas Intermediate Crude Oil market has initially fallen during the trading session on Tuesday but recovered yet again as we have seen this happen three days in a row. Initially, sellers come in and push oil markets much lower, only to see buyers get involved and try to push to the upside. All things been equal, this is a market that I think continues to look at the uptrend line underneath as a bit of support, just as the 50 day EMA sits in that same area.

All that being said, it is obvious that the market is in the middle of a huge ascending triangle, and I think we are in fact trying to respect that. The $67.50 level above is resistance and the top of the triangle, so if we break above there then it is likely that we go looking towards the $70 level. The $70 level above is a large, round, psychologically significant figure that comes into play. That is an area that I think it is going to see quite a bit of pressure to the downside, but if we break above there then it allows for a huge move to the upside. Looking at the last three days, it is obvious that there are plenty of buyers out there willing to take advantage of every dip that comes along.

Keep in mind that a lot of traders out there pay close attention to the coronavirus figures coming out of places like India and Brazil, which are climbing. That is not good for crude oil, and the idea of demand. However, a lot of traders are out there focusing on the reopening trade in general, and of course OPEC and British Petroleum both have suggested that there should be at least a 6 million a barrel gain in demand for the rest the year. At this point in time, I think we are looking at a scenario that will continue to see plenty of volatility yet upward momentum. With that being the case, the market is likely to see a lot of noise overall, but I do think that it is only a matter of time before value hunters come into pick this market up. I have no interest in shorting but if we did break down below the $60 level, I think that could change some things.