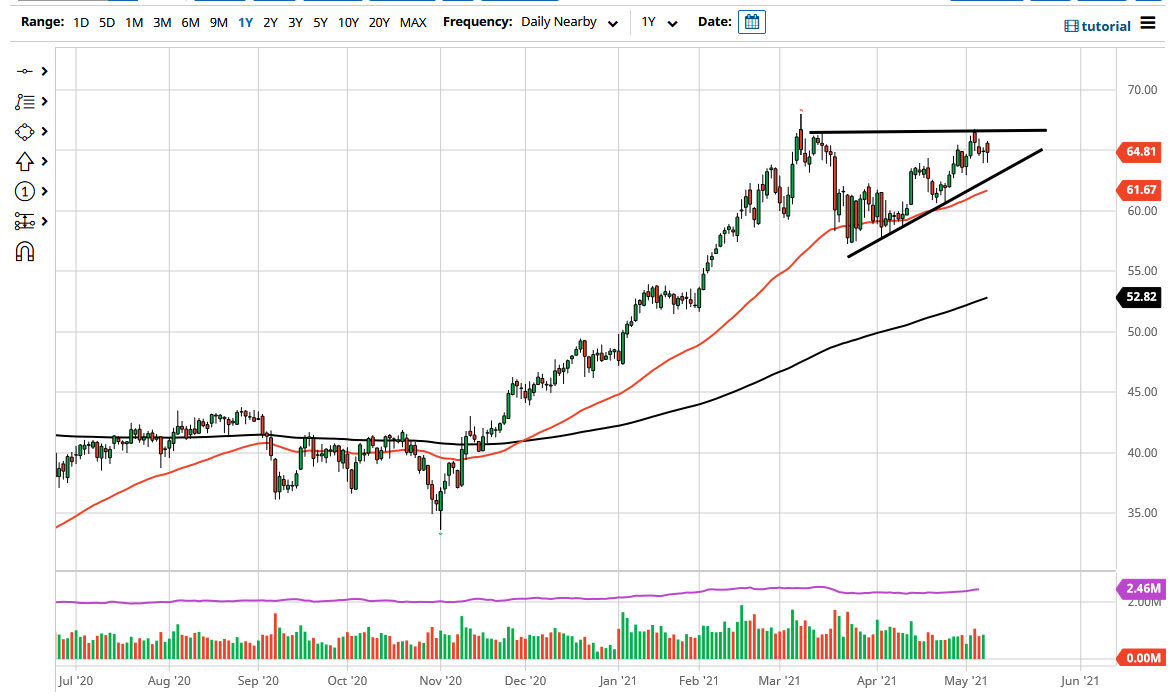

The West Texas Intermediate Crude Oil market fell significantly during most of the trading session on Monday but recovered by the end of the day. By doing so, we have formed a bit of a hammer, and it does look like the $65 level is trying to offer a bit of a springboard to go higher. After all, the crude oil markets are trying to represent the idea of the “reopening trade”, which in theory should demand more crude oil going forward.

Furthermore, we have been in an uptrend for quite some time, and we are trying to break out of the massive ascending triangle, which most of the market out there sees. The 50-day EMA is walking right along the uptrend line from the bottom of the ascending triangle, so at this point I do not have any interest whatsoever in trying to short this market. I think there are plenty of buyers underneath that will continue to jump in and try to take advantage of what has been a well-established trade to the upside, although there are competing fundamental factors going on right now that could continue to cause some issues.

The first thing is that the fact that the OPEC members have decided to increase production puts downward pressure on crude oil, but at the same time, they claim that there will be an additional 6 million barrels needed per day throughout the rest of the year. Beyond that, we are looking at the possibility of worldwide demand picking up in several spots at the same time, so that is a strong sign.

On the negative side, the coronavirus figures in places like Italy and Brazil continue to climb, which is negative for the idea of a lot of emerging markets demanding fuel. Beyond that, we also have to pay attention to the US dollar, but right now it seems to be fading in strength, and that helps the idea of the commodity gaining strength. Regardless, there is not much on this chart that tells me we should be shorting, so buying on the dips, especially after a couple of hammer-like candlesticks, makes the most sense going forward until we break down below the $60 level at the very least.