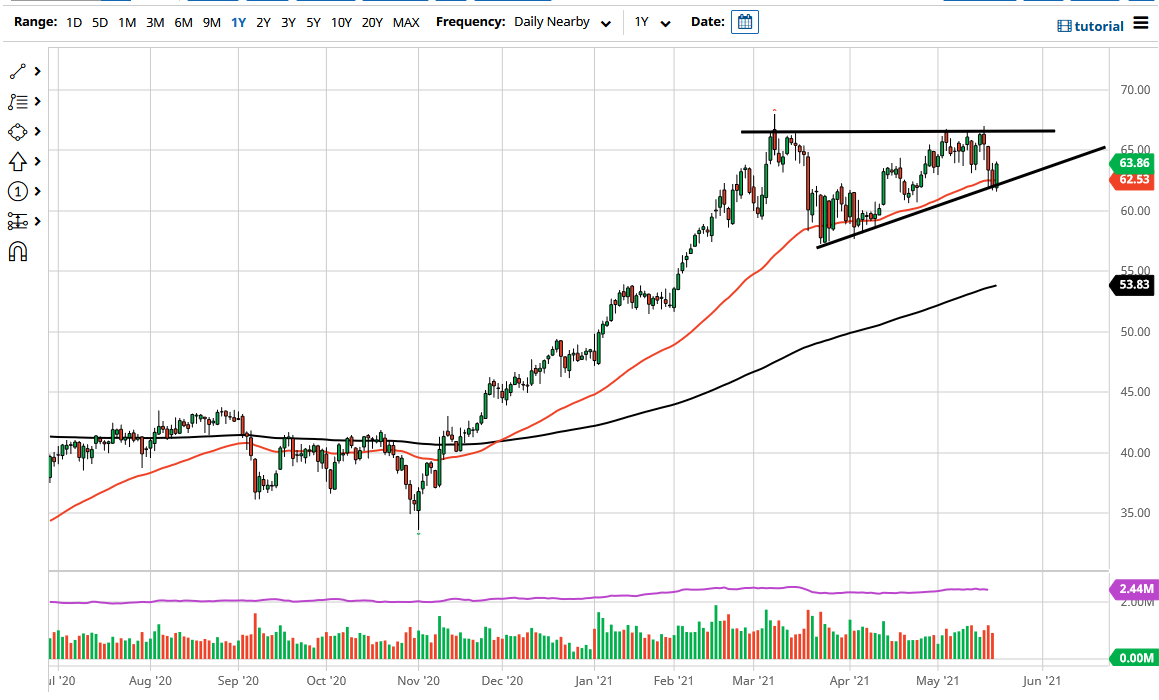

The West Texas Intermediate Crude Oil market rallied rather significantly during the trading session on Friday to show signs of resiliency. Because of this, the market looks likely to continue going higher as we have seen quite a bit of concern about the Iranians being able to sell more crude, which would raise the supply that could drive down pricing. However, I think the market is starting to look past that again, and I think at this point in time the market is ready to go towards the top of the triangle.

The $67.50 level above is massive resistance as shown by the triangle, and if we can break above there then it could send this market towards the $70 level. If we can break above there, then the market is likely to go looking towards the $72.50 level. In general, this is a market that I think will continue to hear a lot of noisy behavior but should continue to find plenty of buyers on these dips. In fact, the way that the market closed during the session tells me that we are more likely than not to see a bit of follow-through. With that in mind, I like the idea of buying short-term dips.

If we were to break down below the uptrend line, then it is possible that we could go looking towards the $60 level, possibly even the $57.50 level. At that point, the 200-day EMA starts to come back into the picture, showing that we are going to continue to go to the upside. The market is going to continue to focus on the “reopening trade”, which is the main driver of oil in general. After all, the stronger the economy is, the more demand that we will see for crude oil. We have recently had some hiccups when it comes to India and Brazil regarding virus numbers, but I think this is a market that you cannot sell, at least not until something drastic happens. I continue to see this as a market that short-term traders will pick up every time it drops off. Because of this, it is more than likely a scenario in which we cannot be sellers.