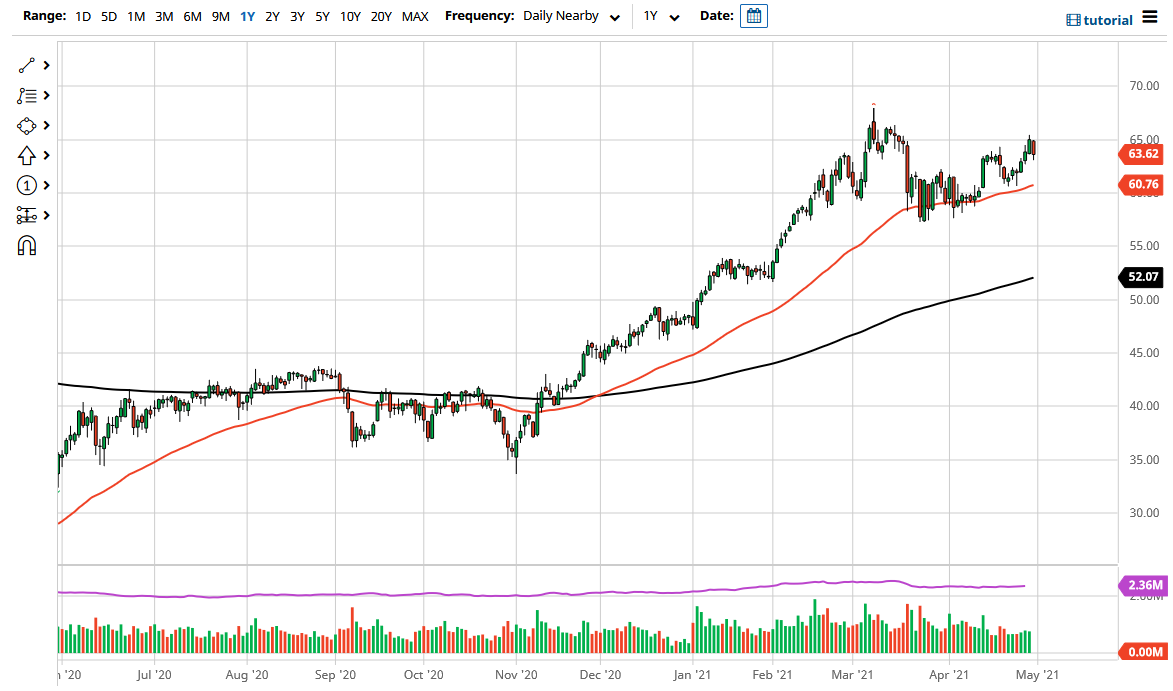

The West Texas Intermediate Crude Oil market fell rather hard during the trading session on Friday, showing signs of exhaustion at the $65 level. The $65 level is an area where we have seen selling pressure previously, so it does make sense that we sought it again this past 24 hours. That being said, the trend is still to the upside, and I could even make an argument for a little bit of an ascending triangle that is trying to be formed here. At the very least, we could talk about a potential channel to the upside over the last couple of months.

Underneath the potential channel, we have the 50-day EMA offering support as well, so it is likely that we would continue to see buyers based upon that technical indicator. We have been in an uptrend for quite some time, even though we had a nice pullback recently, which suggests that there could be a little bit of value in the market. Therefore, I believe that if we see a supportive candlestick or some type of bullish impulsive candlestick, we can go long.

If we did break down below the 50-day EMA, then it is very likely that we could go looking towards the 200-day EMA. However, that is the least likely of scenarios as most traders are playing the “reopening trade” through the oil market. It also helps that OPEC+ and British Petroleum both have suggested that the demand for crude oil should continue to gain 6 million barrels a day for the rest of the year, despite the fact that India, Brazil and Japan are all suffering from a resurgence in the coronavirus. Most of the demand increase that they see are in places like the United States, China, the European Union and the United Kingdom.

This is a market that you should be buying on dips, as although Friday was relatively rough, the reality is that we tested a major resistance barrier, and it was the end of the month when people were taking profit in what had been very strong gains to report back to clients. Now that that is out of the way, people will start to look at the longer-term trend.