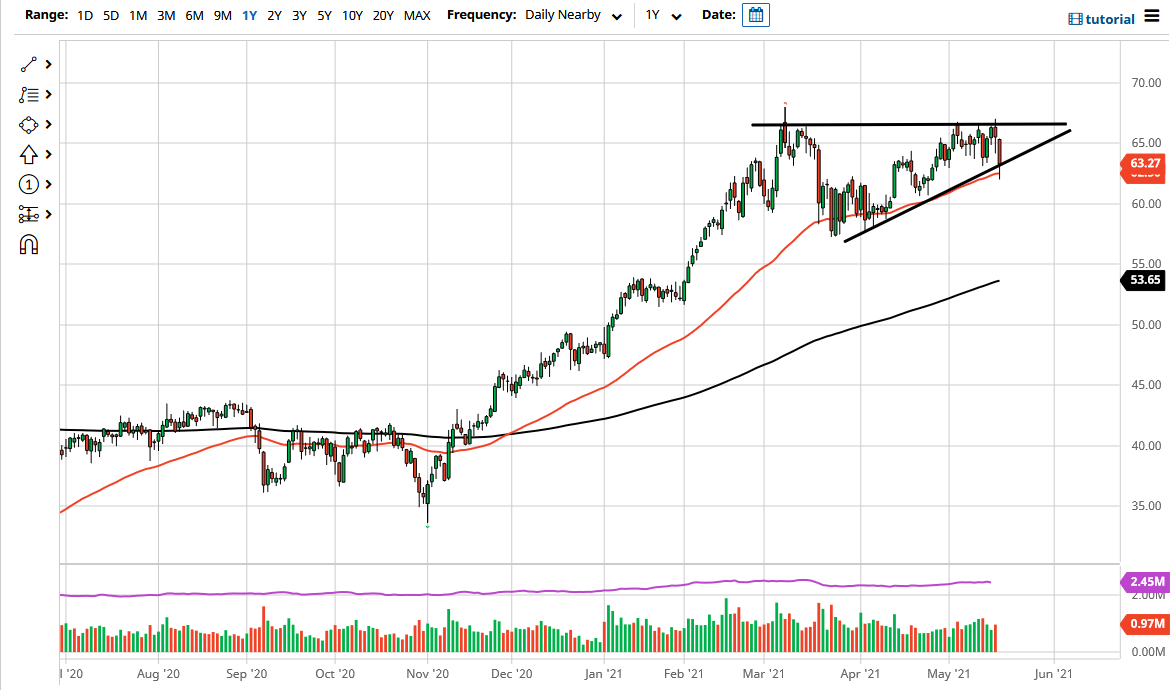

The West Texas Intermediate Crude Oil market fell hard during the trading session on Wednesday as pretty much everything out there got hammered. Looking at this chart, you can see that the Wednesday candlestick was particularly nasty, as we broke down below the 50-day EMA at one point, but had gotten far too ahead of ourselves to the downside. When you look at this chart, you can see that the uptrend line has held, although it certainly has been pierced.

Looking at the chart, we have been in an ascending triangle for some time, so if this holds, we could see buyers come in and push this market to the upside. Looking at this candlestick, we do have a long wick to the bottom so it at least gives us some hope that we could see players push this market to the upside. The $65 level above is a large, round, psychologically significant figure that people will be paying close attention to.

As you can see, we have been in an uptrend for some time, so it is likely that buyers would come back in given enough time. It is obvious to me also that we have a major amount of resistance above, but it is not quite significant enough for me to be worried about the potential of a “double top” that I have been hearing some people talk about. After all, people are still banking on the “reopening trade”, and that will demand a significant amount of crude oil.

British Petroleum and OPEC both have recently stated that they believe demand worldwide will pick up by 6 million barrels per day by the end of the year. That being said, the one thing that people are concerned about is the fact that we are seeing coronavirus figures pick up in places like India, which is the third largest importer of crude oil, so we could see a significant amount of trouble. Nonetheless, it is only a matter of time before we start to see demand pick up in other places, and eventually India will come on board as well. At this point, it certainly looks as if we are trying to stabilize the market, but if we break down below the bottom of the candlestick, then I think the market could go looking towards the $60 level, possibly even the $58 level.