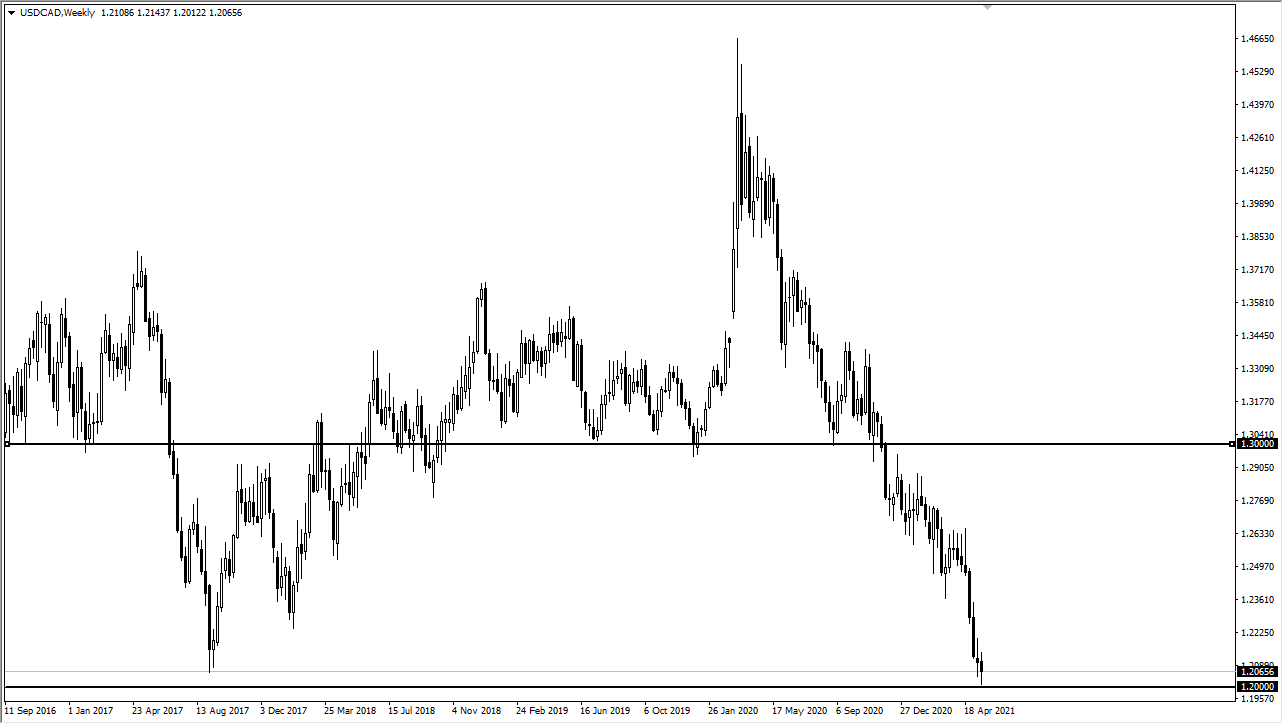

EUR/USD

The euro initially shot higher during the trading session at the end of the week but gave back the gains above the 1.22 handle. By doing so, the market ended up formed a bit of a shooting star, showing some hesitation. In general, this is a market that I think will continue to be very noisy, but will also be a “buy on the dips” scenario as the US dollar continues to struggle. The 1.20 level underneath is a large, round, psychologically significant figure that a lot of people will be paying attention to.

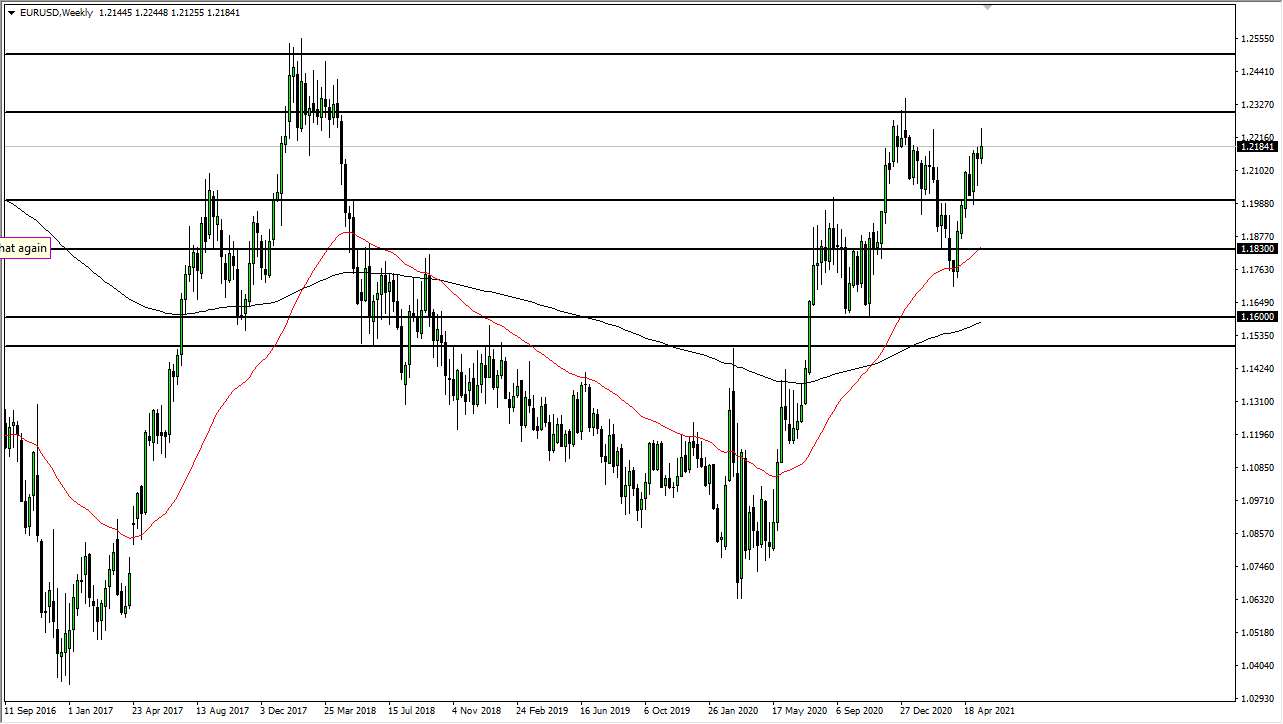

GBP/JPY

The British pound has gone back and forth against the Japanese yen during the week as we had reached towards the ¥155 level, but gave back the gains to form a neutral candlestick. This tells me that the market is very likely to pull back from here, but just like the euro, I believe that this is a market that will find plenty of buyers underneath that could get involved. With that being the case, I think we should wait until we get down to about the ¥153 level to start looking for an opportunity. Alternately, if we do break above the ¥155 level, it would be a major breakout and we could go much higher.

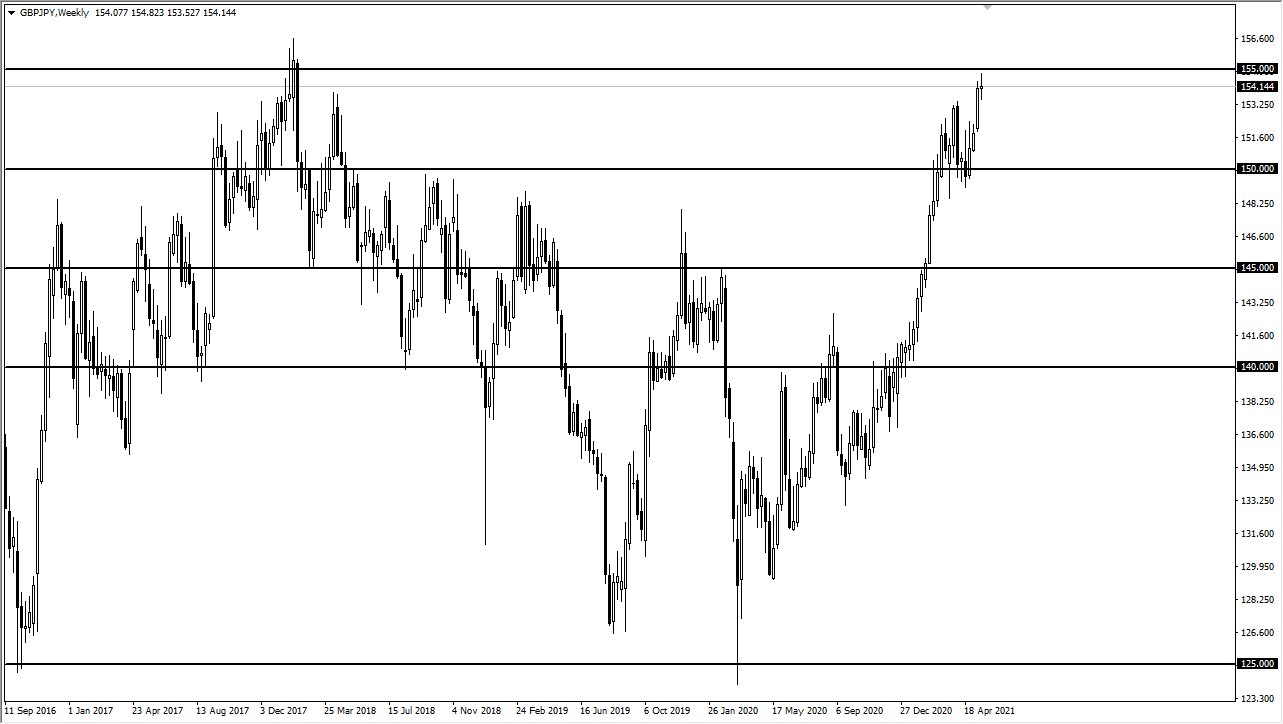

GBP/USD

The British pound rallied significantly during the week to test the 1.42 handle but gave back the gains to show signs of hesitation. By doing so, the market did end up forming a bit of a shooting star, which suggests that we could pull back. By pulling back, I suspect that the buyers would be looking towards the 1.40 level, an area that had been massive support as well as resistance. That being the case, I think that pullbacks should be thought of as an opportunity to take advantage of what is a very strong uptrend.

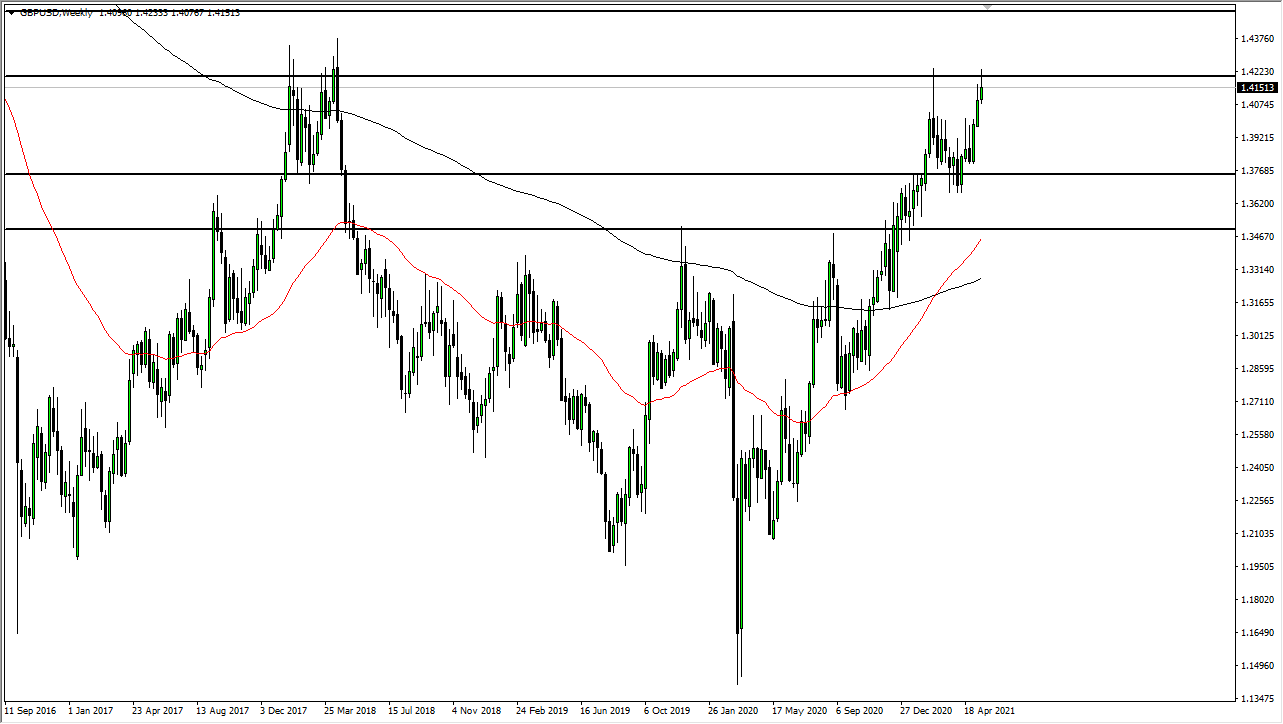

USD/CAD

The US dollar bounced significantly from the 1.20 handle, an area that has been important for some time, and ultimately, I think that if we break down below that level, then it is likely that we could break down rather significantly to go looking at much lower levels. With this being the case, we have to keep an eye open for that, but we ended up forming a bit of a hammer and that could cause a short-term bounce. Nonetheless, I would be cautious about getting long.