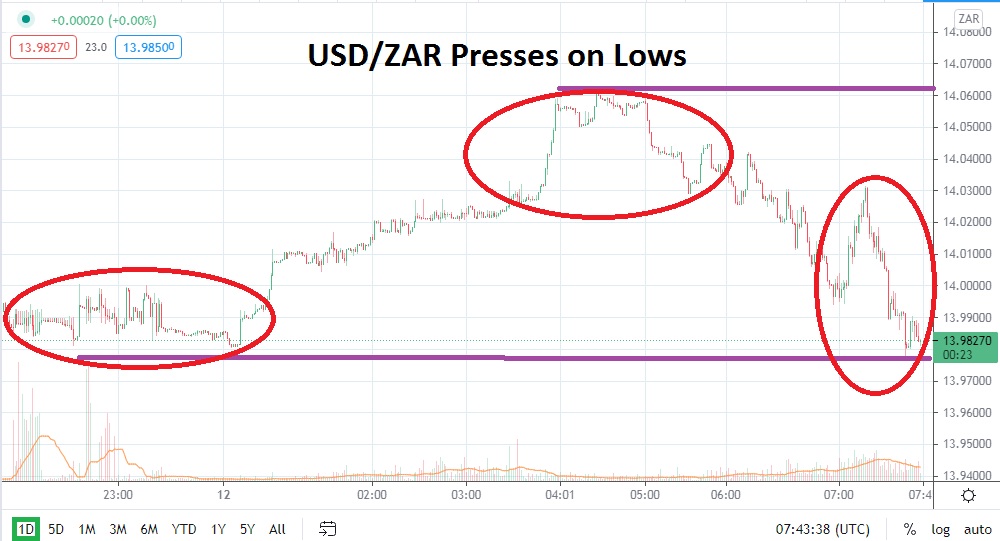

The bearish trend of the USD/ZAR remains unrelenting and speculators must now use long-term charts to contemplate the next potential moves of the Forex pair if they believe that downward pressure will persist. In early trading this morning, the USD/ZAR has penetrated the 14.00000 ratio and is showing signs of being able to sustain values near this mark short term. The last time these price junctures were touched was in December of 2019.

Intriguingly, the previous time the USD/ZAR sustained a serious amount of trading below these depths was in July of 2019, when the 13.8000 value was briefly tested. However, in December of 2019, after hitting the current price vicinity, the USD/ZAR did begin to climb in value. This can ultimately be blamed on the coronavirus implications, which began to dampen financial market sentiment in January of last year.

Curiously, in July of 2019, when the USD/ZAR hit the current depths now being tested, another reversal higher did ensue, which took the Forex pair towards the 15.3500 ratio in August of 2019 before the Forex pair reversed lower. The last time a serious amount of price action was seen below the current values of the USD/ZAR was in December 2018 until February 2019, when a price range of 13.96000 to 13.25000 was tested. The 13.25000 juncture was only tested for about a week in late January of 2019.

These lower values are highlighted to emphasize that the current price of the USD/ZAR is potentially entering values which have proven to hold up well the past few years. The current price of the USD/ZAR does correlate with other major currency pairs as the US dollar remains weaker.

The question for speculators is how much more bearish momentum can be produced within the USD/ZAR. Now may not be the time to speculate on large reversals higher; instead, it may be an opportunity to pursue carefully chosen trading parameters while using solid risk management.

The psychological mark of 14.00000 should be watched closely by USD/ZAR traders. If a tight price range is maintained within the Forex pair and resistance levels prove adequate, speculators may want to try and pursue additional downward momentum. Waiting for slight reversals higher and then igniting selling positions may be the most attractive wager today. Traders should not be too greedy at the current price levels and use take-profit orders which cash in winning positions if they are produced.

South African Rand Short-Term Outlook:

Current Resistance: 14.07000

Current Support: 13.93000

High Target: 14.17000

Low Target: 13.72000