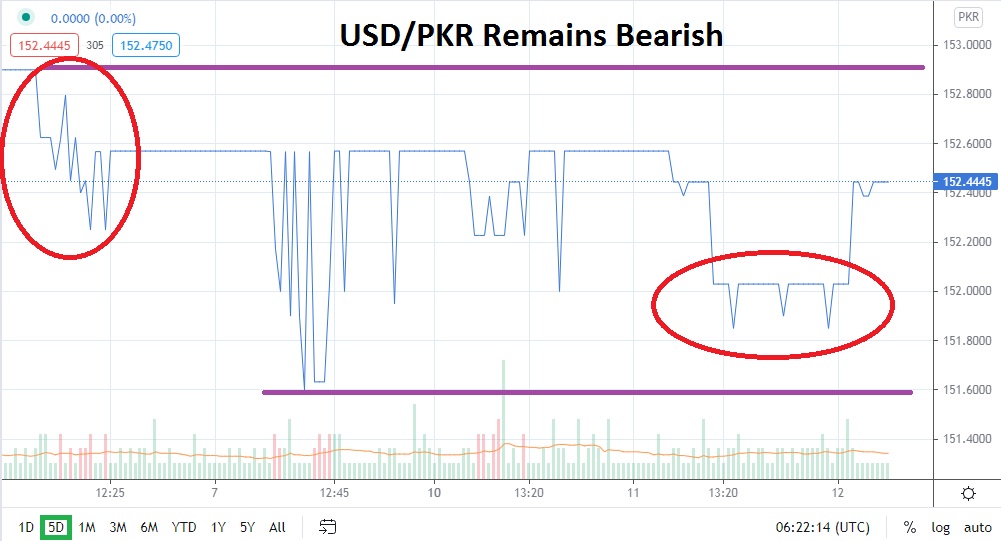

The USD/PKR remains within the lower depths of a solid bearish trend. After testing support yesterday and early today, the USD/PKR has reversed slightly higher. However, important lows remains within sight and might prove quite tempting for speculators who have the ability to trade the Forex pair.

Support near the 151.9000 juncture has been touched recently, but it has also proven rather durable. Junctures of 151.7000 to 151.5000 are certainly being inspected by technical traders who can clearly see that these levels were tested early in April and late in the first week of May. The last time the USD/PKR has been able to truly sustain values below these important values was in June of 2019. What makes these low water marks extremely enticing for speculators is that if the 151.5000 ratio is proven vulnerable with more bearish momentum, a rather large technical void exists, which saw the 148.0000 price the first week of June 2019.

However, this doesn’t mean traders should anticipate these lowest values near term, but it serves as a reminder of price ranges which were traded almost two years ago. The point being, if the USD/PKR is able to puncture its current support levels, it will certainly set off a test of pricing which may become rather volatile and traders need to be prepared.

The USD/PKR should always be traded via limit orders to protect against rather ugly price fills. Traders need to understand there is not a great deal of transactional volume within the USD/PKR and it is susceptible to rather dramatic spikes. The use of take-profit and limit orders is highly encouraged too. Traders should understand that carrying the USD/PKR with an overnight position may lead to charges that need to be factored into the arithmetic.

Global risk appetite has been tested early this week with rather tumultuous trading. Short-term traders need to understand the dynamics that sentiment have on the markets, but the USD/PKR has produced a rather tantalizing bearish trend since this January. While some traders may want to look for brief reversals upward, cautious traders may want to simply wait for moves higher towards resistance and use them as a potential price ratio to activate a limit order which is selling the USD/PKR.

Pakistani Rupee Short-Term Outlook:

Current Resistance: 152.7500

Current Support: 151.9000

High Target: 153.6000

Low Target: 151.5000