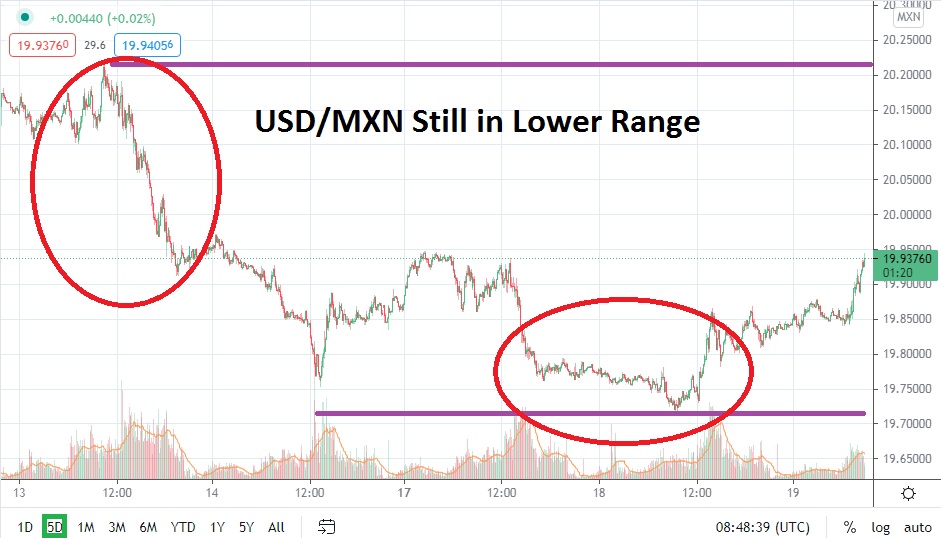

The USD/MXN continues to traverse near key support levels. A low of nearly 19.71000 was demonstrated yesterday and then a slight higher reversal developed. However, the ability of the USD/MXN to maintain its value below the 20.00000 remains intriguing, and speculators who believe that bearish sentiment remains the dominant feature of its trend cannot be blamed.

Curiously, the resistance levels of the USD/MXN have lowered also the past couple of days. While the test of lows near the 19.71000 mark are enticing, the additional fact that resistance levels have not been challenged significantly with volatile spikes may be a signal that technically the USD/MXN has additional downside action which could develop.

Yesterday’s test of lows touched values not seen since January of this year. As the USD/MXN trades currently above the 19.90000 juncture, traders may believe that the junctures of 19.86000 to 19.75000 offer attractive opportunities as take-profit targets short term. Resistance levels have certainly lowered the past couple of days and speculators could be tempted to put stop-loss ratios near the 19.99000 to 20.00000 junctures.

The bearish trajectory of the USD/MXN is susceptible to reversals higher; on the 12th of May, the Forex pair challenged the 20.20000 mark. Traders who want to speculate on cyclical reversals in the USD/MXN which move towards higher resistance levels cannot be faulted, but they should use quick-hitting take-profit orders to cash out winnings before they vanish.

From a risk/reward scenario, in the short term, it appears that simply waiting for slight reversals higher and selling the USD/MXN may make the most sense. The current price action of the USD/MXN continues to indicate that bearish sentiment is prevalent and, if the 19.90000 mark is sustained and values puncture this juncture lower and hold, traders may suspect that more selling is going to occur.

The long-term trend of the USD/MXN remains on a downward trajectory. Yes, the Forex pair can deliver volatile results, but the last five days of trading have been rather sedate. If the USD/MXN breaks above 20.00000, the 20.09000 could become a focus, but traders may remain more intrigued by the notion that short-term momentum is bearish and look for price action that is geared towards lower values.

Mexican Peso Short-Term Outlook:

Current Resistance: 19.96000

Current Support: 19.86000

High Target: 20.09000

Low Target: 19.71000