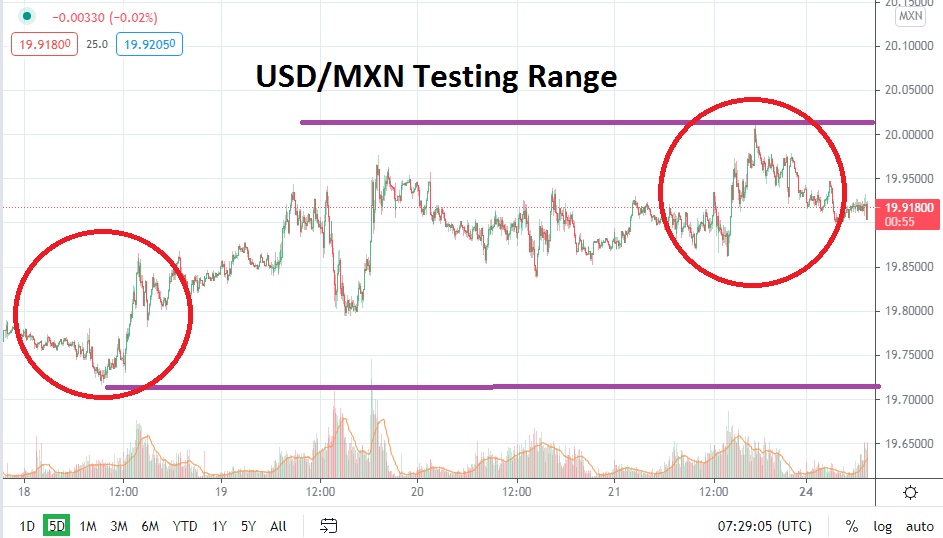

The USD/MXN has produced rather tight trading conditions the past few days, but intriguingly, resistance levels above the 20.00000 juncture appear to be getting stronger. While support levels have proven to also be strong in the short term, the USD/MXN continues to trade with a healthy dose of rather tranquil values. On the 18th of May, the USD/MXN did touch the 19.71000 mark and then produced a reversal higher towards the 19.97000 level.

On the 21st of May, the USD/MXN did trade slightly above the 20.00000 price, but as the day came to a close, the Forex pair was again close to the 19.90000 ratio. Traders who remain speculatively bearish may be making the correct choice regarding direction, but they need to also acknowledge the strength that support levels have produced the past handful of days.

Traders should keep their eyes on level of 19.90000; this mark appears to be rather important as an inflection point. The last time the USD/MXN traded below the low of 19.71000 consistently was in January of this year. It appears that the junctures of 19.90000 to 19.80000 will have to be repeatedly tested, and that programmed buying around these marks needs to erode before the USD/MXN extends its bearish momentum.

Traders who want to pursue short reversals higher at the current values of the USD/MXN cannot be faulted, but they will likely need quick-hitting limit orders positions with relatively fast take-profits ready to cash in winning positions. From a risk/reward perspective, the downside of the USD/MXN may appear limited short term, but this also means that speculators would be wagering against the trend.

The notion that resistance levels have proven rather robust the past few days of trading may prove enticing for speculative sellers. Conservative traders may want to wait for slight reversals higher as the USD/MXN tests resistance levels above, but shorting the USD/MXN continues to look like it may prove to be the correct choice. Technically, the USD/MXN has produced a solid mid-term bearish range since early March. If the Forex pair can continue to traverse lower and prove the 14.90000 value can be penetrated and prices can be sustained, the junctures of 19.87000 to 19.83000 could prove tempting short term.

Mexican Peso Short-Term Outlook:

Current Resistance: 19.97000

Current Support: 19.89000

High Target: 20.02000

Low Target: 19.83000