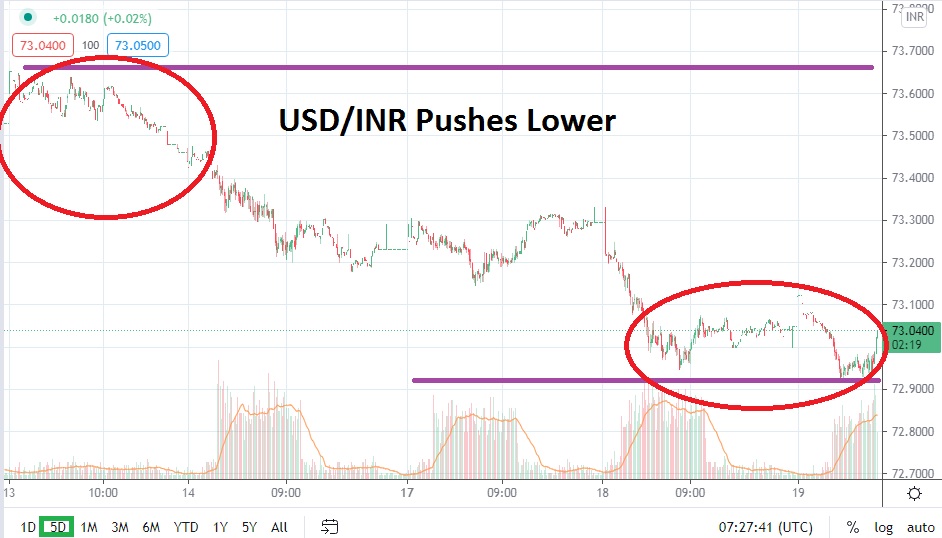

The USD/INR has traded lower the past couple of days as its bearish trend remains intact. Interestingly for speculators is the notion that, from a technical viewpoint, the selling in the USD/INR has been accomplished incrementally. The bearish trend has not been sudden, nor has it experienced violent surges. The move lower has a polite quality which may signal that the USD/INR continues to search for its equilibrium in a rather tranquil manner.

The USD/INR is currently near the 73.1000 ratio, but it did break below the 73.0000 mark in early trading today. Psychologically, it makes sense that the 73.0000 juncture may prove to be an important inflection point short term. If the value of the USD/INR can see a sustained amount of trading below this level, it may be signaling that further bearish movement is going to develop. However, because the USD/INR has demonstrated its bearish trend in a rather incremental way, traders should not become overly ambitious regarding the targets below they are seeking if they are pursuing bearish activity.

The USD/INR certainly has mid-term support levels in sight which are important. A look at a three-month chart shows that the current value of the Forex pair is testing late March values. If current support junctures prove vulnerable, traders may believe that another test of the 72.8200 to 72.3500 will flourish rapidly.

However, while the USD/INR is situated above the 73.0000 juncture, some speculators may believe that the Forex pair is overdue for a slight reversal higher. Forex trading is not a one-way street and, if current support levels prove durable in the short term, a move towards nearby resistance around the 73.1900 could be legitimately anticipated as a buying wager.

The USD/INR continues to show bearish momentum, but the rather quiet way the Forex pair has trended downwards opens the door for speculators to remain tactically able to look for quick-hitting trades via selling and buying. From a risk/reward scenario, the USD/INR’s juncture of 73.0000 should be watched closely. If this level is broken lower and shows staying power below this ratio, bearish selling could become pronounced. Until then, traders should use limit, take-profit and stop-loss orders and look to take advantage of short-term cyclical reversals.

Indian Rupee Short-Term Outlook:

Current Resistance: 73.1900

Current Support: 72.9100

High Target: 73.3600

Low Target: 72.7100